BlackRock, MSCI being investigated by House Select Committee on China

House committee alleges that BlackRock, while not breaking any laws, facilitates flow of US capital to Chinese entities

BlackRock's Rick Rieder: Fed could cut rates as soon as the second half of 2024

BlackRock global fixed income CIO Rick Rieder discusses how rising interest rates could affect the bond trade and when the Fed will start cutting on 'The Claman Countdown.'

A U.S. House committee is launching a probe into the largest asset management company in the world concerning the flow of capital out of the U.S. and into the People's Republic of China.

The House Select Committee on the Chinese Communist Party sent a letter Monday to BlackRock asserting that the asset management company has invested more than $429 million in Chinese companies "that pose national security risks to and act directly against the interests of the United States."

The committee launched a similar probe into MSCI Inc., a major stock market index-compiler, also accused of facilitating investment into Chinese Communist Party-affiliated corporations.

BLACKROCK WANTS BOTH HIGH CREDIT SCORES AND NOT TO GO OUT OF BUSINESS: JIMMY FAILLA

A car drives past a BlackRock Inc. billboard advertisement in Hong Kong.

Neither company has not been accused of breaking the law with its investment practices.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,056.38 | +1.58 | +0.15% |

| MSCI | MSCI INC. | 557.78 | -8.12 | -1.43% |

"Like many global asset managers, BlackRock offers our clients a number of strategies to invest in or exclude China from their portfolios. The majority of our clients’ investments in China are through index funds, and we are one of 16 asset managers currently offering US index funds investing in Chinese companies," BlackRock told FOX Business in a statement.

CHINA IS ROLLING OUT THE RED CARPET FOR US CEOs

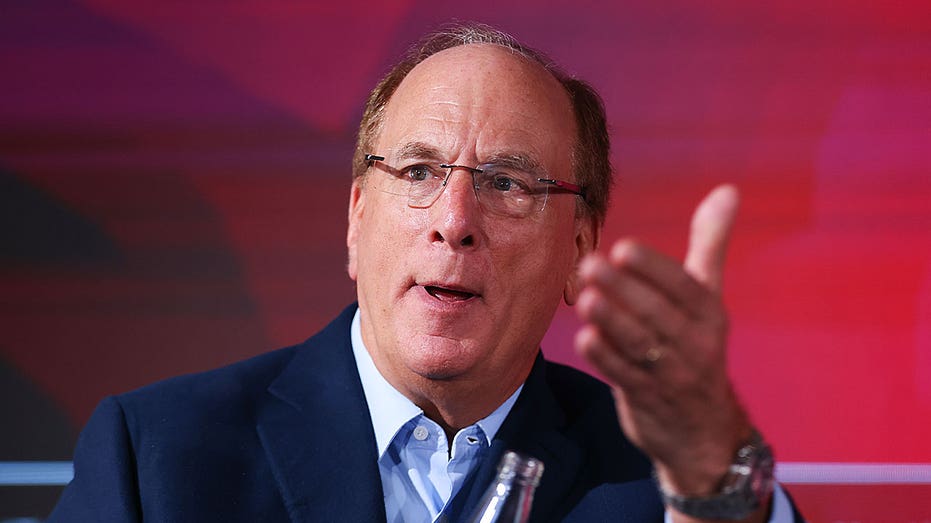

Larry Fink, chairman and chief executive officer of BlackRock, speaks at event on the sidelines of the opening day of the World Economic Forum in Davos, Switzerland. (Hollie Adams / Getty Images)

BlackRock has just over $9 trillion in assets under management.

"With all investments in China and markets around the world, BlackRock complies with all applicable U.S. government laws. We will continue engaging with the Select Committee directly on the issues raised," BlackRock added.

In addition to security risks posed by investment in CCP-adjacent entities, the House committee also alleges that large amounts of U.S. capital is being directed toward Chinese companies with records of human rights abuses.

CLICK HERE TO READ MORE ON FOX BUSINESS

Pedestrians walk past a BlackRock Inc. billboard advertisement in Hong Kong.

"It is unconscionable for any U.S. company to profit from investments that fuel the military advancement of America’s foremost foreign adversary and facilitate human rights abuses," the committee wrote in a letter to BlackRock CEO and Chairman Larry Fink.

READ THE COMMITTEE LETTER TO BLACKROCK - APP USERS, CLICK HERE:

MSCI said in a statement that the company is "currently reviewing the inquiry from the House Select Committee on Strategic Competition between the United States and the Chinese Communist Party."