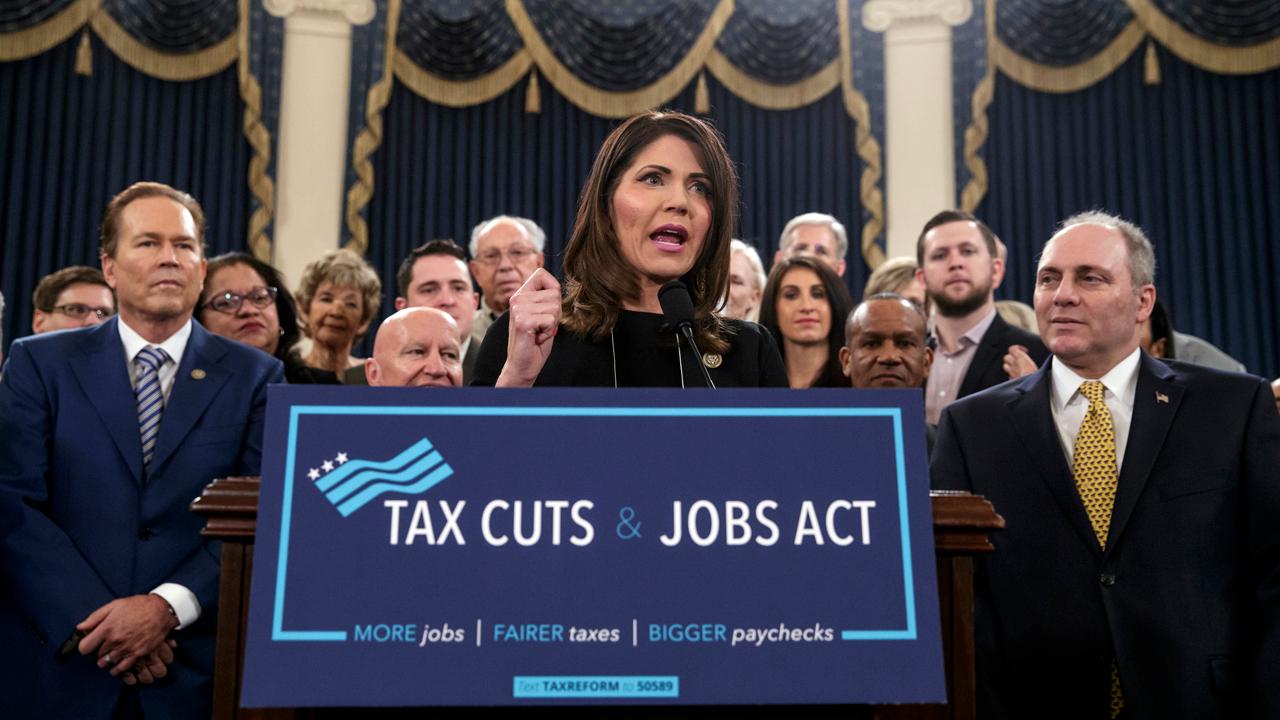

GOP aims to kill the estate tax: What it means for you

Under the GOP’s proposed tax law, the estate tax exemption will be doubled over the near-term, up from $5.49 million currently for individuals and nearly $11 million for married couples.

After six years, the GOP plans to eliminate the tax entirely.

Here’s what that means for taxpayers:

In 2017, there were an estimated 11,300 estate returns filed, but only 5,500 of them were taxable, according to data from the Tax Policy Center. The amount of taxable returns will decrease under the current proposal, because it increases the exemption threshold. Therefore, only wealthy individuals passing on high-value assets will be subject to the 40% tax through 2024, when it is due to be repealed entirely.

“I do think that it’s very exciting that it’s going to be phased out and ultimately eliminated in 2024,” William Kambas, partner at Withers Bergman, told FOX Business. “It gives a lot of people comfort that the estate tax revenue is of diminishing value.”

The proposed plan keeps the “step-up in basis provision,” which essentially means the decedent can pass on an asset that has appreciated in value since its original acquisition tax-free. Taxes will only be levied from the time the inheritor receives the asset to the time when they decide to sell it. This is particularly valuable, Kambas points out, for beneficiaries in high-tax states whose assets are subject to both state and federal estate taxes.

It also provides a substantial break for the wealthiest Americans.

“The people who are going to gain are really the wealthiest people in the country,” Jeffrey Geida, partner at Weinstock Manion, told FOX Business. “When you have a repeal of the estate tax combined with keeping the step-up in basis rules … It [benefits] people with really, really substantial assets.”

The short-term increase in the estate tax exemption will chiefly benefit people that have a net worth between $10 million and $20 million, Geida added.

Meanwhile, the top rate for the gift tax would be reduced by 5 percentage points to 35%, while the lifetime exemption threshold would increase.

Cumulatively, the proposed changes to the estate tax could have a negative impact on charitable giving, Geida said.

“For most really wealthy clients … they’re slowly shifting assets down to their kids and grandkids,” he said. “Once they decide ... they’ve given them enough … they give to their charity, they give to their private foundation … [Under this proposal] there would be no benefit to giving money to charity on their death.”

Estate planning

It is important to keep in mind that the entire tax plan will be up for amendments and votes in Congress throughout the coming weeks. Additionally, the decision to eliminate the estate tax could be reversed before it is fully implemented by the year 2024.

As such, Kambas recommends individuals don’t center their estate planning on perceived tax benefits.

“I think that there are many reasons to engage in estate planning well beyond what your effective tax rate is going to be,” he said. “So that whether we have this repeal or not, there’s absolutely reason to continue planning, whether you’re rich or poor. The non-tax reasons are still vitally important from an estate planner’s perspective.”

Geida agreed, saying he wouldn’t advise any of his clients to make changes based on the current proposal.

“Once this bill becomes law, it could look a lot different,” he said.