The estate tax will be dead by 2024 if GOP tax plan passes

The new House Republican tax reform plan released on Thursday calls for changes to the estate tax, otherwise known as the “death tax,” including its elimination after a period of six years.

Currently, single taxpayers can leave up to $5.49 million tax-free to their heirs, while married couples can leave up to nearly $11 million. Any amount above those figures means beneficiaries would be faced with a 40% federal estate tax.

The estate tax exemption, under the new plan called the Tax Cuts and Jobs Act, will double and eventually be repealed after 2023. The provision will maintain the beneficiary’s “stepped-up basis,” meaning if an asset is inherited and then sold for more money than its original cost, the person would not pay a capital gains tax.

“Economists tend to see the estate tax as one of the most economically harmful taxes per dollar of revenue raised,” Jared Walczak, senior policy analyst at the Tax Foundation, told FOX Business. “By raising the estate tax threshold and ultimately repealing the estate tax outright, the Tax Cuts and Jobs Act would remove an impediment to economic growth.”

Some argue that the tax in its current form hurts farms and family-owned business in America and that it is essentially a form of double taxation, since the assets being passed down have already been taxed as income.

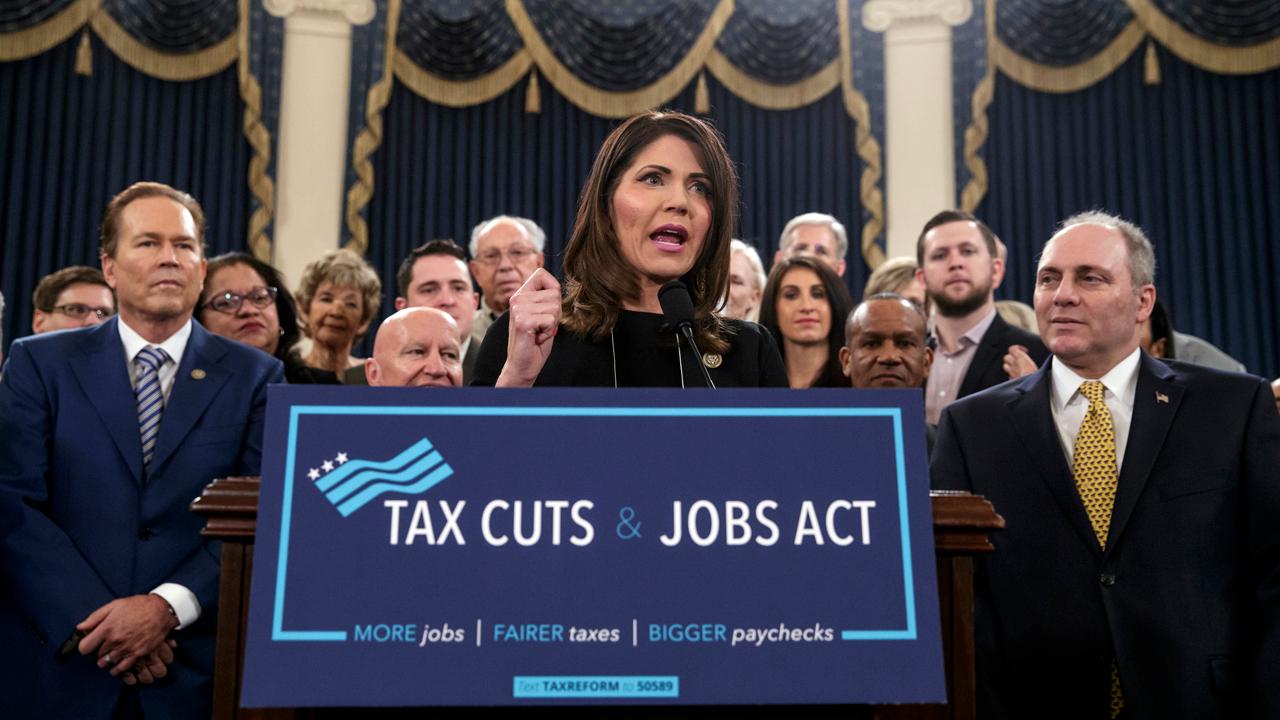

“If we’re really going to get back to a tax code that helps people and doesn’t harm them, that’s fair, that doesn’t have special provisions or penalties by us picking winners and losers, then we have to repeal the death tax,” House Ways and Means Committee member Kristi Noem (R-S.D.), whose father was killed in an accident on the family’s farm, said during the unveiling of the tax plan on Capitol Hill on Thursday.

House Ways and Means Committee Ranking Member Richard Neal (D-Mass.) criticized the plan upon its release, calling it a “rushed” and “partisan” plan that “yielded over 400 pages of broken promises to middle-class families.”

“This bill falls short of reform, falls short of middle-class tax relief and falls short of the fiscal principles to which Republicans have long held themselves,” Neal said in a statement.

FOX Business’ request for Neal to comment specifically on the estate tax was not returned at the time of publication.