Hunter Biden's family name aided deals with foreign tycoons

Chinese energy tycoon gave Biden a 2.8-carat diamond, according to an investigation by Senate Republicans

Hunter Biden ramped up business activities with European and Chinese tycoons as his father exited the vice presidency four years ago. For him it was a potential path to income; for the tycoons, the Biden family name promised to burnish their reputations.

The dealings got the younger Mr. Biden a discounted stake in a private-equity firm in China and consulting arrangements with a Romanian property magnate and overall allowed him to maintain a globe-trotting lifestyle, according to interviews, documents and communications reviewed by The Wall Street Journal. A Chinese energy tycoon gave Mr. Biden a 2.8-carat diamond, and entities linked to him wired nearly $5 million to Mr. Biden’s law firm, according to an investigation by Senate Republicans.

These arrangements now loom over President-elect Joe Biden. A federal criminal tax investigation into Hunter Biden’s business dealings is under way, with findings potentially trickling out in coming months. His business ties to well-connected people in China and other places could add to scrutiny of foreign-policy decisions taken by the Biden administration over possible conflicts of interest. All are likely to provide ammunition to Republicans.

Sen. Chuck Grassley (R., Iowa), who has led the Senate Finance Committee whose Republican staff helped investigate Hunter Biden, has said he would continue to look into what he says are possible counterintelligence and criminal concerns related to Mr. Biden’s business dealings.

“Based on all the facts known to date, Joe Biden has a lot of explaining to do,” Mr. Grassley said recently.

HOUSE DEMS WILL TRY TO PASS $2K STIMULUS CHECKS THIS WEEK

Hunter Biden has said he takes the tax investigation “very seriously” and is “confident that a professional and objective review of these matters will demonstrate that I handled my affairs legally and appropriately.” He declined to comment for this article and his lawyer, George Mesires, didn’t respond to questions. In 2019, Mr. Biden said he wouldn’t work with any foreign companies if his father were elected U.S. president.

None of the Journal’s reporting found that Joe Biden was involved in his son’s business activities. The tax investigation doesn’t implicate the president-elect, according to people familiar with the matter.

In a statement this month about the investigation, the president-elect said he is “deeply proud of his son.”

He told reporters Tuesday he had not and would not discuss the federal tax investigation with prospective attorney general candidates.

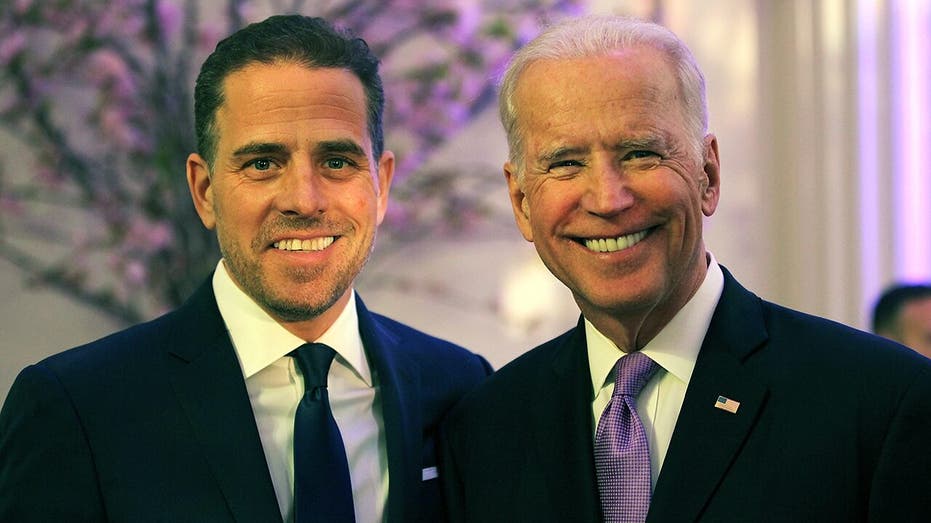

Hunter Biden, left, and his father, Joe Biden, right (Getty Images)

“The attorney general of the United States of America is not the president’s lawyer,” the president-elect said. “I will appoint someone who I expect to enforce the law as the law is written, not guided by me.”

Joe Biden also has previously said his family members won’t be involved in businesses that appear to create a conflict of interest and won’t have “a business relationship with anyone that relates to a foreign corporation or a foreign country.”

DID COVID RELIEF ACTUALLY COST YOU $46,000 IN YOUR RETIREMENT ACCOUNT?

Some of Hunter Biden’s business deals appeared to go nowhere. Sometimes his contribution mainly consisted of making introductions to important people in business and government, according to people involved and documents.

Still, legal and consulting services he provided offered a way to generate income; the Senate Republicans’ report says the millions of dollars in wire transfers from entities linked to Shanghai energy entrepreneur Ye Jianming were described as payment for such services.

The tycoons who sought out Mr. Biden as a business partner were looking to build ties to the Washington establishment that Joe Biden inhabited for decades, and by doing so, smooth the way for major deals or ward off legal troubles, according to interviews, documents and communications. For businessmen in some countries, paying for introductions and getting close to people in power or their relatives is a normal part of doing business, and the son of a veteran American politician offered a potential trove of connections.

Mr. Ye “would say if you find a strong partner, then opportunities can flow just from this relationship,” said a former subordinate.

Mr. Biden, in an exchange about putting together a venture with Mr. Ye, pointed to the value of his family name: “Just happens that in this instance only one player holds the trump card and that’s me. May not be fair but it’s the reality because I’m the only one putting an entire family legacy on the line,” he wrote in a 2017 text message to an associate in the venture and viewed by the Journal.

A graduate of Yale Law School, Hunter Biden was for a period a registered lobbyist in Washington. He also worked in boutique investment and property development firms along with American partners who sometimes tried to raise capital among the newly well-heeled in the former Soviet Union and China.

President Trump and some Republican allies have tried over the past two years to draw attention to Hunter Biden’s business activities—an effort that took off as Joe Biden emerged as a likely presidential challenger.

A particular focus was Hunter Biden’s board seat with Ukrainian natural-gas company Burisma Holdings. When he joined the board in 2014, Burisma’s founder Mykola Zlochevsky was looking to raise the company’s standing in Washington, as he parried legal inquiries abroad and at home where the government was vowing to clean up corruption. Mr. Biden was paid roughly $50,000 a month from 2014 to 2019. For the first three years, then-Vice President Joe Biden served as the Obama administration’s point man for international anticorruption efforts in Ukraine.

Mr. Trump and his allies have alleged corruption by the Bidens. Mr. Trump’s request to Ukraine’s president in 2019 to announce an investigation into the Bidens figured into Mr. Trump’s impeachment; the GOP-controlled Senate ultimately acquitted him.

Joe and Hunter Biden denied any wrongdoing. Hunter Biden later said he displayed poor judgment in accepting the board seat. Two Obama administration officials raised concerns to the White House in 2015 that Hunter Biden’s seat on the Burisma board could create a perceived conflict of interest while his father was leading Ukraine policy, according to the Senate Republicans’ investigation, which was released in September. The investigation didn’t support Mr. Trump’s claims that Joe Biden had distorted U.S. policy to favor his son.

As his father prepared to leave office and political life in early 2017, Hunter Biden’s overseas business activities picked up, moving beyond directorships into shareholding and consulting arrangements, primarily with Chinese entities.

Central to this was the Chinese energy tycoon, Mr. Ye. His CEFC China Energy Co. was China’s largest private oil company, riding a global acquisition binge to buy up oil fields in Chad, production rights in the United Arab Emirates and a swath of financial holdings in the Czech Republic. Mr. Ye had links to Chinese military intelligence and in many countries worked to nurture ties with politically influential people to aid deal-making.

By 2017, Mr. Ye and Hunter Biden had struck up a relationship leading to the formation of the joint venture, which also included Mr. Biden’s uncle, James Biden, who owns an investment firm and has been associated with his brother’s political campaigns. James Biden said he and Hunter helped Mr. Ye get his daughter into an exclusive Manhattan private school, according to text messages the Journal reviewed. James Biden didn’t respond to questions.

“I was his first guest at his new apartment he cooked me lunch himself and we ate in the kitchen together,” Hunter Biden wrote in one message to a business associate after visiting Mr. Ye’s $50 million New York penthouse. “He has me helping on a number of his personal issues.”

That associate, a Los Angeles businessman named Tony Bobulinski, was a partner along with Hunter and James Biden and several others in SinoHawk Holdings LLC, a venture in which CEFC would hold a 50% stake and promised to fund in whole with $10 million.

Mr. Bobulinski, who attended the final presidential debate as a guest of the Trump campaign, said he was initially excited about working with Mr. Biden and CEFC, so he agreed to handle the leg work of establishing the joint venture. In October, Mr. Bobulinski shared hundreds of emails, texts and other correspondence from Mr. Biden and his partners with the Journal. He said he was frustrated that SinoHawk never got the seed money promised by CEFC, and the frustration grew when he read in the Senate report about wire transfers to Mr. Biden.

Many of the communications can’t be verified without Mr. Biden and other partners, who declined to answer questions when contacted by the Journal. Interviews, public records and findings of Senate Republicans support many of the events they describe.

SinoHawk looked for infrastructure projects that CEFC would fund, and the venture produced a business plan that outlined possible investments around Europe, including Romania, and in Oman and Colombia, sometimes building on Hunter Biden’s and James Biden’s personal relationships with politicians. As possible contacts in the U.S., the business plan listed more than two dozen American politicians.

“We have forged alliances with the highest levels of government, banking and enterprise,” noted an April 2017 strategy summary by the SinoHawk team that was marked as sensitive and confidential.

In the spring of 2017, Mr. Biden moved between Los Angeles, Miami and New York as part of the push to get SinoHawk going.

In May 2017, texts and other communications show Mr. Biden traveled to Bucharest to connect with CEFC executives. CEFC was in the midst of a push into Central Europe, and in Bucharest, the executives met with the prime minister, according to a Romanian government statement, as the company was looking to expand beyond gas stations and refineries and move into local infrastructure and finance.

At the same time Mr. Biden was trying to help CEFC expand, he was advising a wealthy Romanian facing legal troubles and trying to unload property assets. Gabriel “Puiu” Popoviciu turned to Mr. Biden for legal and business advice when a corruption conviction threatened his real-estate empire, and a person familiar with the situation says the pair met a few times a year over champagne at a high-end Bucharest club, Loft Diplomat.

Another Chinese businessman who had feted Mr. Biden was Beijing financier Jonathan Li, founder of private-equity firm Bohai Harvest RST (Shanghai) Equity Investment Fund Management Co. Mr. Biden had been an unpaid director of BHR from its inception in 2013 when plans called for it to target U.S. investments, though his lawyer and others involved have previously said he had virtually no role.

Then in October 2017, Mr. Biden joined Mr. Li as a shareholder in BHR, according to regulatory filings in China. BHR was funded by Bank of China Ltd. and other big government financial firms. By then, BHR had been part of at least 10 major acquisitions, initial public offerings and other deals that pushed its assets above $1 billion. Still, the cost for Mr. Biden’s 10% stake, at $420,000, was based on BHR’s startup value in 2013, filings show. Of that, at least a third was provided in the form of loans from other BHR principals, according to people familiar with the situation.

After a BHR-invested company, lithium-battery giant Contemporary Amperex Technology Ltd. , went public on the Shenzhen Stock Exchange in June 2018, a portion of IPO proceeds due to Hunter Biden was credited instead toward repaying the debt and went to a principal at the private-equity firm. The principal named Wang Xin confirmed the arrangement and said the lending was “perfectly legal, reasonable, and as far from corruption or any of the suggested fallacies as the sun is far from the earth.”

Chinese IPOs are highly sought after and are routinely a one-way bet for those who get a so-called cornerstone slice, as BHR did with shares in CATL, valued at $28 million the day it went public. Shareholders, including Mr. Biden, profited when CATL stock surged from there by the maximum 44% in the debut session, and kept going afterward.

A statement released by Mr. Biden’s lawyer last year said Mr. Biden “has not received any return on his investment” in BHR.

The international activity coincided with personal and financial challenges for Mr. Biden.

Mr. Biden had been discharged from the Navy reserves when he failed a drug test in 2014, and in 2017 divorce proceedings, Mr. Biden’s ex-wife Kathleen Buhle Biden claimed the couple owed a tax debt of at least $313,970. Her filing said they had maxed out credit cards and taken out double mortgages on their properties, accusing Mr. Biden of spending extravagantly, including over $120,000 in one two-month period. Public records show several tax liens placed against him in recent years, with some satisfied and one withdrawn.

The SinoHawk venture never got off the ground. But starting in August 2017, entities linked to CEFC’s Mr. Ye executed the wire transfers listed as covering legal and advisory costs totaling $4.79 million to Mr. Biden’s Washington law firm, Owasco PC, according to the Senate Republicans’ report. The transfers also covered over $100,000 for bills on credit cards issued to Hunter, James and James’s wife, Sara Biden, the report said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Journal has reported that government investigators zeroed in on Hunter Biden in response to suspicious-activity reports by a bank in the U.S. that handled foreign transactions for him. In their investigation, Senate Republicans requested suspicious-activity records from the Treasury Department.

The Justice Department has declined to comment on the matter, which is being handled from the U.S. attorney’s office in Delaware.

By the time Hunter Biden pledged in October 2019 that he wouldn’t serve on any foreign board of directors if his father were elected, he had already stepped down from Ukraine’s Burisma. CEFC had virtually collapsed. Mr. Ye had disappeared more than a year earlier following the prosecution in New York of one of his deputies on corruption charges.

Mr. Biden’s October 2019 statement, issued through his lawyer, Mr. Mesires, stopped short of promising he would divest foreign holdings. Corporate records in China suggest he hasn’t.

CLICK HERE TO READ MORE ON FOX BUSINESS

A Delaware-registered corporation, Skaneateles LLC, controlled by Mr. Biden, still owns 10% of the Chinese private-equity firm BHR, the records show. A sale of Mr. Biden’s BHR stake is possible but complicated by the difficulty of valuing the firm’s holdings of unlisted assets. A person close to BHR says the international scrutiny Mr. Biden’s involvement has drawn has limited the company’s deal making.

“We didn’t know what kind of lightning rod he would be,” the person said.

—Valentina Pop in Brussels, Elisa Cho in New York and Xie Yu in Hong Kong contributed to this article.