Why investors are welcoming the demise of the 'Blue Wave' and what it means for next 2 years

For at least two more years, America’s economic environment will likely bear more resemblance to the Trump agenda of lower taxes and regulation

The 2020 presidential election count is far from over, but a divided government appears almost certain and investors are signaling they're happy about it.

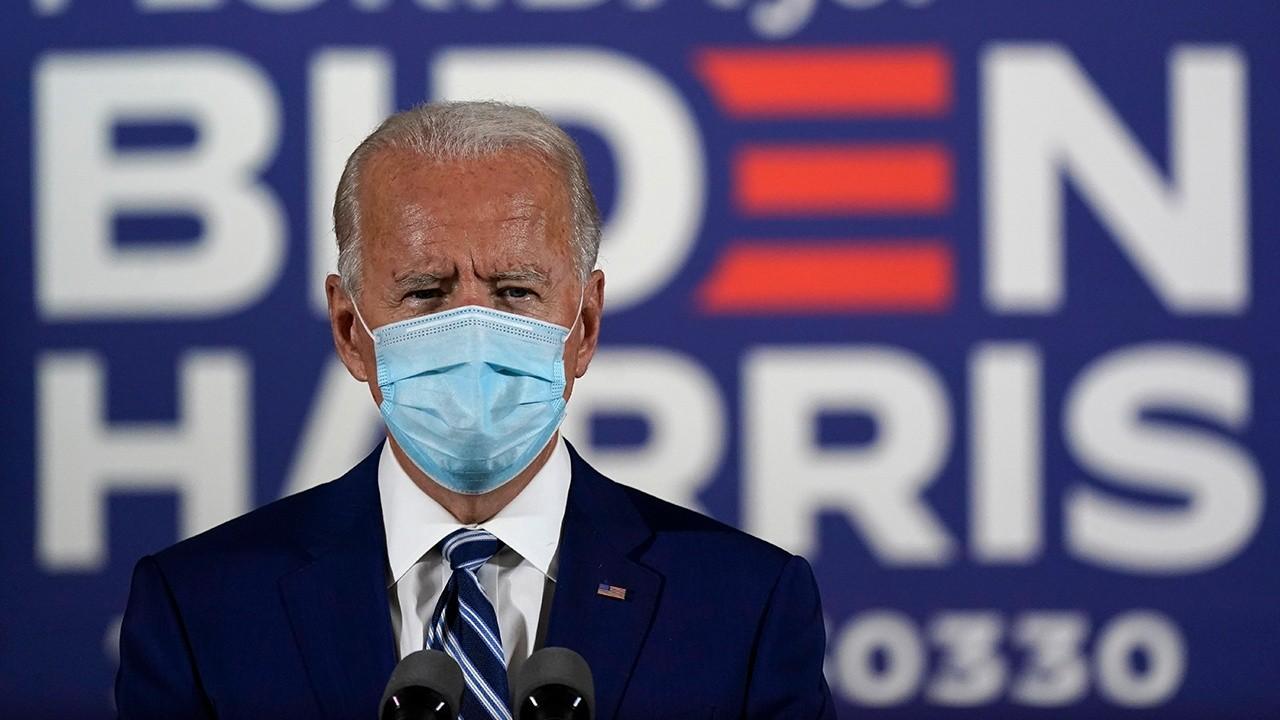

Even with the possibility of a Joe Biden presidency, concerns over a "Blue Wave" of tax hikes and massive new regulation are fading fast as Republicans look poised to hold the Senate and check progressive economic ambitions. That has investors breathing a sigh of relief and sending stocks higher.

The conventional wisdom is that the stock market loves divided government, but it's more accurate to say that markets fear radical economic policy change. Indeed, investors cheered unified Republican control of the White House, House of Representatives, and Senate after the 2016 election on the promise—and eventual delivery—of lower taxes and relief from a growing regulatory state.

But the prospect of unified government under a Biden administration offers quite the opposite, and that’s why investors are welcoming the demise of the Blue Wave.

WALL STREET RALLIES AS VOTE COUNTS HINT AT DIVIDED GOVERNMENT

Democratic presidential nominee Joe Biden was not shy about promising tax hikes on investors, corporations, and individuals as a "day one" priority, and both Speaker Nancy Pelosi, D-Calif., in the House and Sen. Chuck Schumer, D-N.Y., in the Senate were eager to help lead the charge.

Neither was Biden shy about his extensive plans to push a "Green New Deal"-inspired agenda of costly regulations and restrictions that would have hit American energy, transportation, and heavy manufacturing particularly hard.

TRUMP CAMPAIGN CLAIMS COURT VICTORY IN PHILADELPHIA

The issue for investors wasn’t simply a unified government, but the kind of heavily progressive economic policy a potential Biden-led government was ready to push.

The conventional wisdom is that the stock market loves divided government, but it's more accurate to say that markets fear radical economic policy change.

Republicans retaining control of the Senate would effectively put a brake on these ambitions. Investors know there is no way we'll see a rollback of the Trump tax cuts or the implementation of a Green New Deal spending and regulatory agenda with Sen. Mitch McConnell returning to his Majority Leader post.

But, in this case, the benefits of divided government for investors go beyond checking dangerous legislation. If Biden wins the presidency, Republicans will have a say in shaping his cabinet through their constitutional powers to advise and consent. That could be especially helpful when it comes to key posts like Treasury Secretary.

PRESIDENTIAL ELECTION WILL BE DECIDED AT THE BALLOT BOX, NOT IN COURTS, ATTORNEY DAVID BOIES SAYS

Even if Republicans can block legislation in the Senate, control of executive agencies in the government bureaucracy gives cabinet secretaries significant discretion to shape and enforce regulatory policy.

The difference between a more activist, left-leaning Treasury secretary like Sen. Elizabeth Warren, D-Mass., and a more moderate candidate like Federal Reserve Board member Lael Brainerd, would be felt by the banking, energy, and technology sectors that tend to be the object of progressive ire.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

With divided government, businesses—and by extension investors—get protection from an overtly progressive legislative agenda and the less visible but very real threat posed by a more aggressive regulatory bureaucracy.

That means, for at least two more years, America’s economic environment will likely bear more resemblance to the Trump agenda of lower taxes and regulation—and the impressive stock market gains that followed—than anything Joe Biden has on offer.

Voters often complain about gridlock in Congress, but investors know that, more often than not, the less that comes out of D.C., the better. With a divided government looking more and more likely, less is exactly what we can expect. And if markets are any indication, investors are perfectly fine with it.

Brian Brenberg is a professor of Business and Economics at The King’s College in Manhattan. Follow him on Twitter: @BrianBrenberg.