House Republican Rep. DesJarlais to introduce new bill to block Biden student loan relief

Rep. DesJarlais argues that loan forgiveness merely shifts the burden of debt

Student loan debt cancellation ‘very regressive’: Dartmouth college student

Dartmouth College student Kavya Nivarthy discusses her opposition to student loan debt cancellation and describes alternatives to a four-year college degree.

Rep. Scott DesJarlais, R-Tenn., is set to introduce a bill that will aim to block President Biden’s student loan forgiveness plan.

"There's a lot of people out there that took out loans and, you know, maybe didn't get their dream job, but don't pay them back," DesJarlais told FOX Business. "So to somehow decide that they no longer need to have skin in the game, it kind of disincentivizes people from succeeding, in my opinion."

DesJarlais’s bill follows a similar measure put forth by Sen. Mitt Romney, R-Utah, and fellow senators Richard Burr, R-N.C.; Tim Scott, R-S.C.; Bill Cassidy, R-La.; and Thom Tillis, R-N.C.

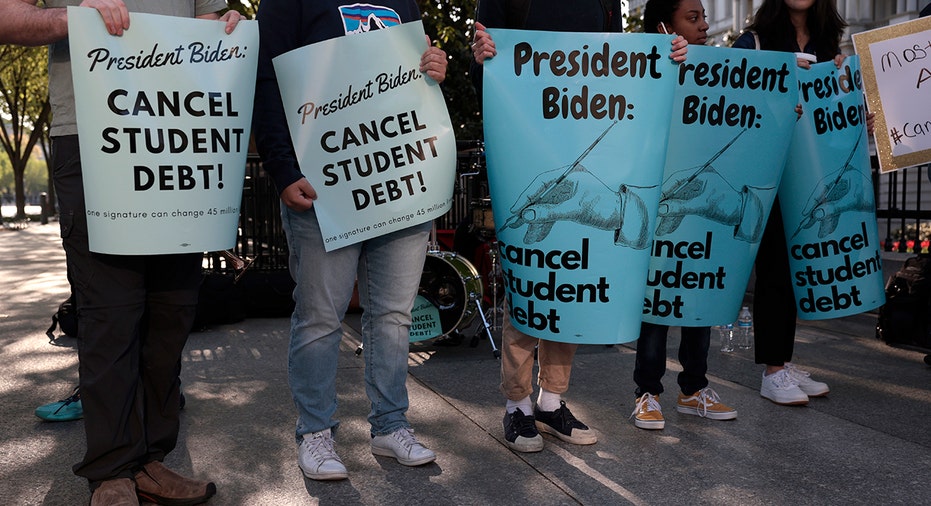

Activists hold signs as they attend a student loan forgiveness rally at Pennsylvania Avenue and 17th Street near the White House April 27, 2022, in Washington, D.C. | Getty Images

The House bill differs from the Senate bill in that it uses more concise language and changes the date of an exemption to cover the regulations "as in effect on" Mar. 12, 2020, rather than the other bill’s date of May 11, 2022.

STUDENT LOAN REFINANCE RATES FREEFALL FOR 5-YEAR VARIABLE-RATE LOANS

The bill’s most aggressive provision aims to limit the secretaries of Education and Treasury, as well as the Attorney General, from taking any action toward forgiving student loan debt, except those carried out as part of the Higher Education Act of 1965.

DesJarlais disagreed that student loan forgiveness can help stimulate the economy since it would merely shift the burden of debt from borrowers to other taxpayers.

COLLEGE GRADUATES NEED THESE 10 ‘INFLATION-PROOF’ CAREER AND MONEY TIPS NOW

"It may help those people who are irresponsible, but the ones that are out there working and paying taxes — now they're going to be saddled with the burden of, if you want to call these other people's mistakes or borrowed money management," DesJarlais argued.

The bill would only affect direct, blanket loan forgiveness, but it would not affect various incentive programs.

10-YEAR-FIXED-RATE PRIVATE STUDENT LOANS DIP AFTER TWO-WEEK UPWARD TREND

"There's an awful lot of scholarship programs out there are going to have one now that you can actually go to college and trade schools for free … There can be maybe some incentive programs where you work off the debt or some of those within the government right now," he continued. "But just erasing somebody that because they weren't able to handle the responsibility they took on, I think is certainly the wrong approach."

The Department of Education on Wednesday announced it would cancel $5.8 billion in full loan discharges for 560,000 borrowers who attended a campus owned or operated by Corinthian Colleges, amounting to the "largest single loan discharge" in department history.

CLICK HERE TO READ MORE ON FOX BUSINESS

That number adds to an already robust $25 billion in student loan relief under Biden. About 43 million federal borrowers still owe a total of $1.6 trillion in college debt, according to the Education Data Initiative.