SEC charges two former FTX associates for roles in crypto exchange's collapse

Caroline Ellison and Gary Wang both face charges from the SEC for their roles in the collapse of FTX

Expect prosecutors to 'flip' people close to FTX founder: Andrew Stoltmann

Securities attorney Andrew Stoltmann discusses the charges against FTX founder Sam Bankman-Fried and what's next for the former crypto CEO on 'Kennedy.'

The Securities and Exchange Commission, or SEC, charged two former associates of Sam Bankman Fried’s who allegedly participated in a multiyear scheme to defraud investors of FTX.

Former Alameda Research CEO Caroline Ellison and Former Chief Technology Officer of FTX Trading LTD Zixiao (Gary) Wang were charged by the SEC on Wednesday.

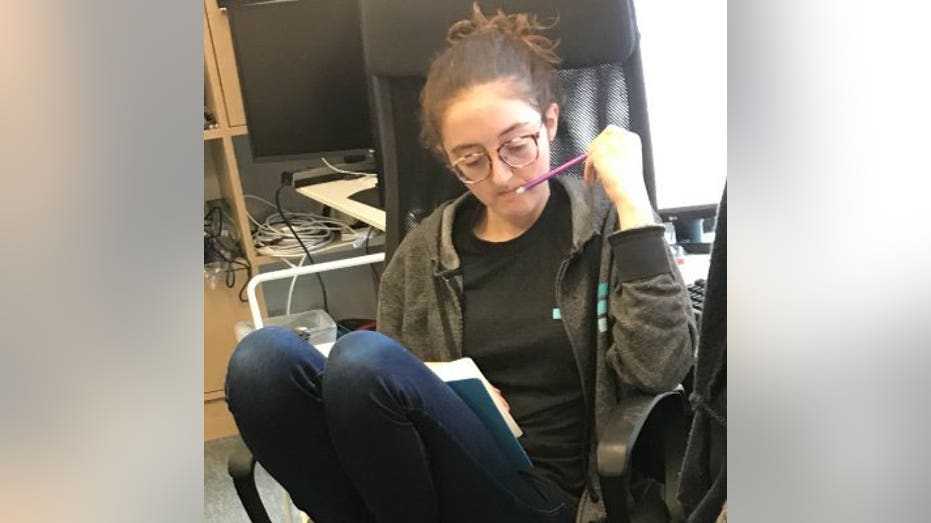

Alameda Research CEO Caroline Ellison via Twitter (Twitter @carolinecapital)

According to a press release from the SEC, Ellison manipulated the price of an FTX-issued exchange crypto security token called FTT, at the direction of Bankman-Fried, by buying copious quantities to increase its price.

FTX FOUNDER SAM BANKMAN-FRIED LEAVES BAHAMAS FOR US AFTER AGREEING TO BE EXTRADITED

FTT, the release read, functioned as collateral for undisclosed loans by FTX of its customers’ assets to Alameda. By manipulating the price of FTT, Ellison and Bankman-Fried allegedly inflated the value of Alameda’s FTT holdings.

As a result, the complaint alleges the value of collateral on Alameda’s balance sheet was overstated and misled investors about FTX’s risk.

The complaint makes several other allegations against Ellison and Wang.

FTX founder Sam Bankman-Fried, center, is escorted from a Corrections Department van as he arrives at the Magistrate Court building for a hearing, in Nassau, Bahamas, Wednesday, Dec. 21, 2022. (AP Photo/Rebecca Blackwell / AP Newsroom)

For instance, from May 2019 to November 2022, Bankman-Fried told investors FTX was safe, and that Alameda was just another customer with no special privileges. Meanwhile, the complaint claims, Wang and Bankman-Fried diverted FTX customer assets to Alameda and the two men knew or should have known the statements they made were false and misleading.

SAM BANKMAN-FRIED ‘CLEARLY HAD OTHER PEOPLE INVOLVED’ IN FTX FRAUD: SUJIT RAMAN

Wang was the creator of FTX’s software code that allowed Alameda to move FTX funds while Ellison utilized FTX funds that were misappropriated for Alameda’s trading activity.

"As part of their deception, we allege that Caroline Ellison and Sam Bankman-Fried schemed to manipulate the price of FTT, an exchange crypto security token that was integral to FTX, to prop up the value of their house of cards," SEC Chair Gary Gensler said. "We further allege that Ms. Ellison and Mr. Wang played an active role in a scheme to misuse FTX customer assets to prop up Alameda and to post collateral for margin trading.

Sam Bankman-Fried, founder and former chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during an interview on an episode of Bloomberg Wealth with David Rubenstein in New York, US, on Wednesday, Aug 17, 2022. Crypto exchange (Photographer: Jeenah Moon/Bloomberg via Getty Images / Getty Images)

"When FTT and the rest of the house of cards collapsed, Mr. Bankman-Fried, Ms. Ellison, and Mr. Wang left investors holding the bag. Until crypto platforms comply with time-tested securities laws, risks to investors will persist. It remains a priority of the SEC to use all of our available tools to bring the industry into compliance," he added.

SAM BANKMAN-FRIED'S EXTRADITION HEARING SET FOR WEDNESDAY

Ellison and Wang are charged with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. As such, the SEC seeks injunctions against both Ellison and Wang that prohibits them from participating in the issuance, purchase, offer, or sale of any securities other than their own.

The SEC also seeks disgorgement of the profits they made illegally, a civil penalty, and an officer and director bar.

Both Ellison and Wang are cooperating with the SEC’s investigation into FTX.

CLICK HERE TO READ MORE ON FOX BUSINESS

The complaint comes on the same day Bankman-Fried departed The Bahamas for the United States after agreeing to be extradited.

He is expected to have his first court appearance in the Southern District of New York and faces spending the rest of his life in prison.

Sam Bankman-Fried used millions in FTX funds to influence an election: Stephen Moore

Freedom Works economist Stephen Moore discusses what will happen to the campaign donations former FTX CEO Sam Bankman-Fried gave to politicians on 'Varney & Co.'