Sen. Warren wants to expand IRS powers beyond the Inflation Reduction Act to prepare tax returns

Giving the IRS the ability to prepare individual tax returns is a controversial idea

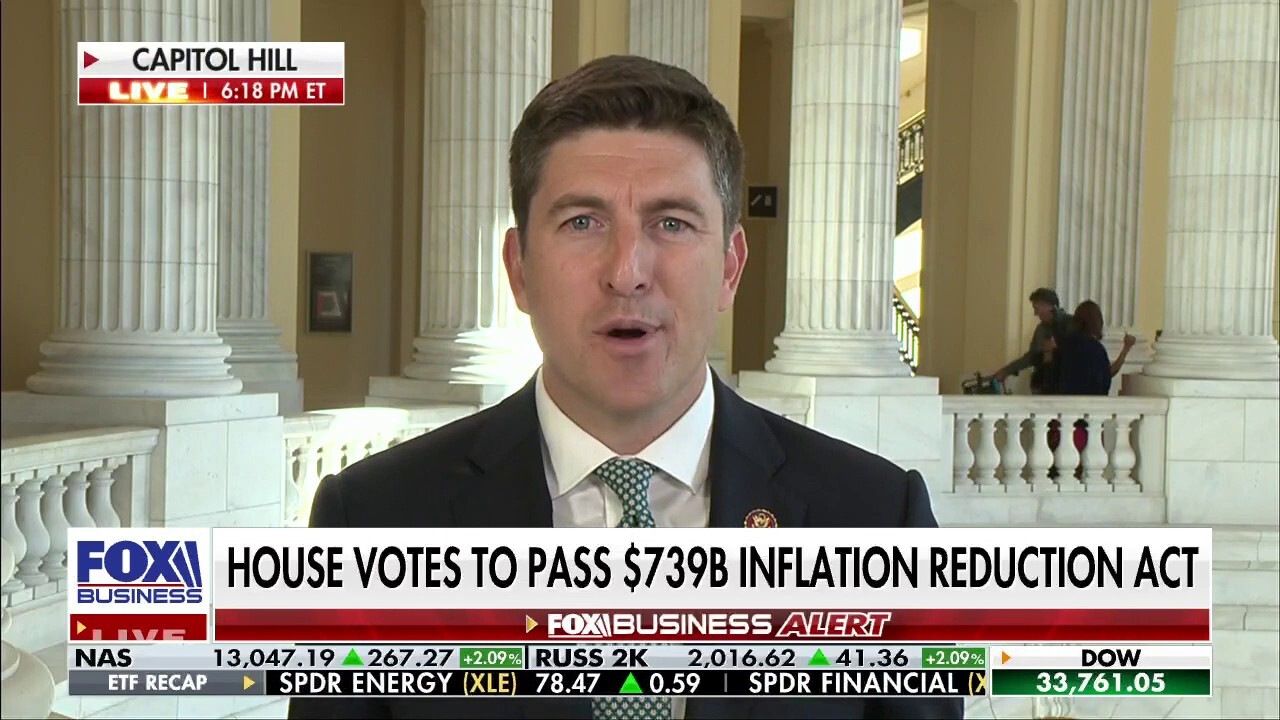

This should come as no surprise from a party that told us inflation was transitory: Bryan Steil

Rep. Bryan Steil discusses how the House voted to pass the $739 billion Inflation Reduction Act on ‘The Evening Edit.’

Tucked into the tax and spending bill that passed the Senate this weekend was a $15 million provision to study allowing the IRS to prepare taxes.

The provision comes after Sen. Elizabeth Warren, D-Mass., and other Democrats have pushed legislation for adding tax filing to the agency's purview.

The Inflation Reduction Act, which passed the House Friday after clearing the Senate — the vote was 50-50 with Vice President Kamala Harris breaking the tie — appropriates almost $80 billion to the tax agency. That would enable the IRS to hire its desired 87,000 agents over the next decade to increase tax enforcement.

A small part of the funding includes $15 million dedicated to fund a task force to study the cost and feasibility of creating a free direct e-file program, which has been a controversial idea.

IRS AUDITS WILL GENERATE $20B FROM THOSE MAKING UNDER $400K UNDER INFLATION REDUCTION ACT

Warren wasn't planning to wait for a task force study and already filed a bill to develop a free, online tax preparation and filing service that allows all taxpayers to prepare and file their taxes directly with the federal government instead of through private tax preparers.

Sen. Elizabeth Warren, D-Mass., speaks during a news conference about the extension of eviction protections in the next coronavirus bill at the U.S. Capitol July 22, 2020. (Drew Angerer/Getty Images / Getty Images)

The Warren proposal would move more quickly to allow filers with simple tax situations to choose a "return-free option" that provides a pre-prepared tax return with an income tax liability or refund amount already calculated. Proponents also say it would reduce tax fraud by getting third-party income information to the IRS earlier in the tax season.

Warren’s bill has 22 Senate Democrat co-sponsors. Representatives Brad Sherman and Katie Porter, both California Democrats, are the lead sponsors of the House version.

"The average American spends 13 hours and $240 every year to file their taxes — that's too much time and too much money," Warren said in July, before Sen. Joe Manchin, D-W.Va., announced his agreement on the reconciliation package.

INFLATION REDUCTION ACT: WHAT TAX HIKES ARE IN THE BILL?

"Congress should pass my Tax Filing Simplification Act, and the IRS itself can and should adopt my plan to simplify the tax filing process for millions of Americans and lower their costs," Warren said.

However, the concept of "return-free filing," or allowing the IRS to control the tax filing for mostly low-income individuals has critics on both sides of the political spectrum.

For one, it presents a clear conflict of interest, said Grover Norquist, president of the conservative Americans for Tax Reform.

"The IRS is the prosecutor and the judge under this system. All the incentives are wrong," Norquist told FOX Business.

Grover Norquist, founder and president of Americans for Tax Reform (Nicholas Kamm/AFP via Getty Images / Getty Images)

On the left, a 2020 report from the Progressive Policy Institute argued this system could prevent some low earners from getting the Earned Income Tax Credit.

"The IRS does not have the necessary information in its databases to accurately determine a low-income taxpayer’s eligibility for EITC and/or correctly calculate the amount of credit due to the taxpayer — indeed, far from it," the Progressive Policy Institute report says. "The EITC is based on a stew of residency, family relationship and income limits with complex tiebreaker rules."

Moreover, the IRS has demonstrated numerous problems handling the responsibilities it already has, Norquist contends.

"This is an agency that thoroughly needs reform, and that’s no time to give it more responsibilities," Norquist said. "They would say they just need more money. No more money until it reforms."

Norquist added this system did not work when it was attempted in Britain.

The Treasury Inspector General for Tax Administration, the internal watchdog of the IRS, reported in 2016 that IRS staff lost 1,000 laptops with sensitive taxpayer information. In 2015, hackers gained access to the data of about 330,000 taxpayers.

More IRS agents means going after middle class: Billionaire

Billionaire CEO and Chairman of United Refining Company John Catsimatidis criticizes the addition of 87,000 IRS agents amid economic problems.

In June, the Taxpayer Advocate Service, a watchdog agency within the IRS, found the agency had more than 21.3 million unprocessed taxpayer returns.

DEMOCRATS' INFLATION REDUCTION ACT COULD MEAN LOWER WAGES FOR MILLIONS OF AMERICANS

The legislation looks to expand a program that was first put in place for the stimulus checks to respond to COVID-19 in 2020. The checks went out to anyone who filed a tax return. For those not required to file a tax return, the IRS issued a regulation to establish "simplified filing" for those that earned too little to file.

A household could provide basic information such as names, and the IRS would do the rest. In 2021, the IRS used this to get information for the Child Tax Credit.

The legislation would make this available to all tax filers.

"American taxpayers spend too much time and money preparing their tax returns. It doesn’t have to be this way," said a statement from Sherman, one of the lead House co-sponsors, who is also a certified public accountant and co-chairman for the House Bipartisan CPA Caucus.

"The Tax Filing Simplification Act represents a commonsense solution to a problem that’s burdened taxpayers for too long — simplifying the tax filing process with fewer costs and complications."

IRS headquarters in Washington, D.C. (Al Drago/Bloomberg via Getty Images / Getty Images)

The IRS also has a Free File system that outsources to private tax preparers to provide free services. However, a Government Accountability Office report in April determined that only about 3% of Americans filing tax returns use the system, while 70% of filers qualify.

Warren blamed the time and costs of tax preparation on large corporations for "sabotaging the Free File program to rake in large profits."

Proponents of the legislation say if it is enacted it would make it easier for people who qualify for the Earned Income Tax Credit and Child Tax Credit and also make tax preparation less expensive.

CLICK HERE TO READ MORE ON FOX BUSINESS

However, a PriceWaterhouseCoopers study from December 2021 determined the compliance costs for individual payers under current rules dropped 40% since 2005.

"Because a significant portion of the population has self-employment income and a greater number use above-the-line deductions, the pool of taxpayers eligible to use a return-free system may be limited without a substantial expansion of information reporting," the PriceWaterhouseCoopers study says.

"Such an expansion would include significant new costs, not only in terms of administrative burden on taxpayers, tax administrators and third parties, but also burdens with respect to taxpayer privacy."