About haleon plc - HLN

Haleon Plc engages in the provision of personal healthcare products. The firm focuses on consumer healthcare. It operates under the following geographical segments: North America, EMEA and LatAm, and Asia Pacific. The company was founded on July 18, 2022 and is headquartered in Weybridge, the United Kingdom.

HLN At a Glance

Haleon Plc

The Heights

Weybridge, Surrey KT13 0NY

| Phone | 44-371-384-2227 | Revenue | 14.35B | |

| Industry | Pharmaceuticals: Major | Net Income | 1.84B | |

| Sector | Health Technology | 2024 Sales Growth | 2.169% | |

| Fiscal Year-end | 12 / 2025 | Employees | N/A | |

| View SEC Filings |

HLN Valuation

| P/E Current | 24.971 |

| P/E Ratio (with extraordinary items) | N/A |

| P/E Ratio (without extraordinary items) | 23.637 |

| Price to Sales Ratio | 3.049 |

| Price to Book Ratio | 2.133 |

| Price to Cash Flow Ratio | 16.99 |

| Enterprise Value to EBITDA | 14.84 |

| Enterprise Value to Sales | 3.741 |

| Total Debt to Enterprise Value | 0.236 |

HLN Efficiency

| Revenue/Employee | N/A |

| Income Per Employee | N/A |

| Receivables Turnover | 5.336 |

| Total Asset Turnover | 0.332 |

HLN Liquidity

| Current Ratio | 0.984 |

| Quick Ratio | 0.779 |

| Cash Ratio | 0.387 |

HLN Profitability

| Gross Margin | 62.69 |

| Operating Margin | 22.327 |

| Pretax Margin | 17.003 |

| Net Margin | 12.837 |

| Return on Assets | 4.266 |

| Return on Equity | 8.898 |

| Return on Total Capital | 5.596 |

| Return on Invested Capital | 5.808 |

HLN Capital Structure

| Total Debt to Total Equity | 62.644 |

| Total Debt to Total Capital | 38.516 |

| Total Debt to Total Assets | 29.512 |

| Long-Term Debt to Equity | 53.446 |

| Long-Term Debt to Total Capital | 32.86 |

Haleon Plc in the News

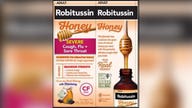

Robitussin cough syrups recalled due to 'microbial contamination,' maker says

Two types and sizes of Robitussin cough syrup have been recalled, its maker announced Wednesday through the U.S. Food and Drug Administration, due to "microbial contamination."