Mortgage applications decrease as high interest rates deter homebuyers: survey

Mortgage refinances continue to fall as interest rates soar, with the index hitting its lowest level since August 2000

'Unprecedented' move in mortgage rates causing problems for homebuyers: Greg Kuhl

Janus Henderson Investors portfolio manager Greg Kuhl discusses how inflation is affecting the real estate market on 'The Claman Countdown.'

Mortgage applications continued on a slight downward trend over the past week, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications weekly survey ending Nov. 4.

The survey showed the Market Composite Index decreased 0.1% on a seasonally adjusted basis from one week earlier. The Index decreased 2% on an unadjusted basis during the same timeframe.

The Refinance Index decreased 4% from the previous week and was 87% lower than the same week last year.

On the other hand, the seasonally adjusted Purchase Index increased 1% during the previous week, while the unadjusted Purchase Index decreased by 1%, making it 41% lower than this time last year.

MORTGAGE HOLDERS LOST MASSIVE AMOUNT OF EQUITY IN THE THIRD QUARTER: REPORT

A residential home loan application is arranged for a photograph. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

MBA Vice President and Deputy Chief Economist Joel Kan stated mortgage rates edged higher last week after the Federal Reserve announced short-term rates will continue to rise in efforts to combat high inflation.

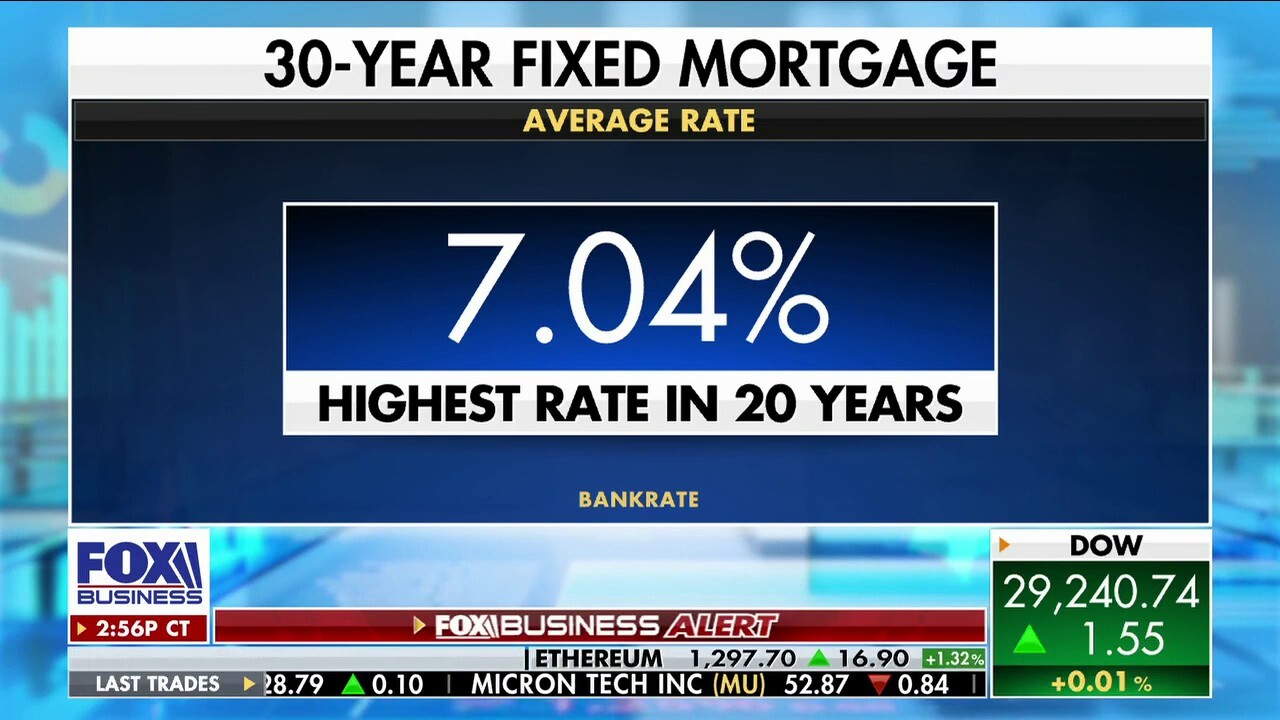

For the third consecutive week, the 30-year fixed rate remained above 7% as most loan types saw increases, Kan said.

"Purchase applications increased for the first time after six weeks of declines but remained close to 2015 lows, as homebuyers remained sidelined by higher rates and ongoing economic uncertainty," Kan added. "Refinances continued to fall, with the index hitting its lowest level since August 2000."

CONFIDENCE IN US HOUSING MARKET HITS A NEW LOW: FANNIE MAE

A sale pending sign is displayed outside a residential home for sale in East Derry, New Hampshire. Sales of previously occupied U.S. homes slowed last month as rising prices and a dearth of homes for sale kept some would-be buyers on the sidelines. (AP Photo/Charles Krupa, File / AP Newsroom)

The survey also found the refinance share of mortgage activity decreased from 28.6% of total applications to 28.1% over a week's time, while the adjustable-rate mortgage share of activity increased to 12% of total applications.

During the past week, the FHA share of total applications slightly decreased from 13.5% to 13.3%, while the VA and USDA shares remained stagnant at 10.3% and 0.5%, respectively.

HOUSING MARKET WILL LEAD US INTO A RECESSION, AND WILL LEAD US OUT: MBA FORECAST

Most average contract interest rates increased over the past week, except for the rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $647,200), which saw a decrease from 6.55% to 6.5%. The points increased from 0.70 to 0.78, including the origination fee, for 80% loan-to-value (LTV) ratio loans while the effective rate decreased.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased from 7.06% to 7.14% and points increased from 0.73 to 0.77, including the origination fee for 80% LTV ratio loans. The effective rate also increased.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 6.86% from 6.7%, with points increasing from 1.18 to 1.37, including the origination fee for 80% LTV loans. The effective rate also increased.

The average contract interest rate for 15-year fixed-rate mortgages increased from 6.37% to 6.4% with points increasing from 1.13 to 1.05, including the origination fee for 80% LTV loans. The effective rate also increased.

A sign indicating a new selling price for a house sits atop a realtor's sign in Jackson, Mississippi. (AP Photo/Rogelio V. Solis)

CLICK HERE TO READ MORE ON FOX BUSINESS

Lastly, the average contract interest rate for 5/1 ARMs increased to 5.87% from 5.79%, with points increasing to 0.92 from 0.9, including the origination fee, for 80% LTV loans. The effective rate also increased from last week.