Sports memorabilia is no longer your father's collectibles anymore

Collectibles has turned into big business with auction and e-commerce sites

FOX Business Flash top headlines for April 12

Here are your FOX Business Flash top headlines for April 12.

The collectibles market has grown immensely since the days of trading cards and sports memorabilia with your friends at home.

Now, with online auction and e-commerce sites, collectibles has turned into big business, as the global market was valued at $412 billion in 2021, and is projected to reach $692.4 billion by 2032, according to research from Market Decipher.

Ross Hoffman, the CEO of Goldin, a leader in trading cards, collectibles and memorabilia, told FOX Business that more and more people are recognizing collectibles as a tradable asset.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXBUSINESS.COM

"So there might be a guy or girl that was a [Jacksonville] Jaguars or [Philadelphia] Eagles fan as a kid, and now they've got disposable income, and they can invest in something they can never have afforded before," Hoffman said. "Brings them qualitative value on the nostalgia side, but also it's a tradable asset and more and more people that are recognizing that. So we think it's continuing to grow."

Sports mural at the Goldin office in Runnemede, New Jersey. (Goldin)

Hoffman said that the industry has spiked a lot since people were forced to stay at home during the coronavirus pandemic, but they also have data going back to 2010 showing that the space has grown immensely. It also continues to grow.

Hoffman said a younger demographic between the ages of 21 to 35 is getting involved with sports collectibles due to explosive growth in modern card collecting, along with NFTs.

"One is the explosive growth in modern card collecting. You have to imagine that most folks who buy most cards are on the younger side and some of these prices are tremendous," he said. "The second is actually NFT collectors, we view that as broadening the aperture of the folks that might want to come in and own a physical asset of something. But a lot of folks that start with NFTs actually come in and say, ‘OK, I actually want something and have it in my house now,’ and they're ending up coming to our site."

Amid a booming collectibles market, Goldin last month announced $330 million in sales for 2021, tripling its prior-year total. The sales increase comes amid a shift from people simply trading baseball cards at home – as they can now invest through secure online sites and marketplaces.

"That to me is the biggest shift, is that when people suddenly feel they can do in a safe way, they are more comfortable doing it," Hoffman said, noting that Goldin has a "vault" that will store physical and digital trading cards, collectibles and memorabilia.

"Well, when you've got an organization that's doing hundreds of millions of dollars in sales a year, there's more trust there," he added. "Our buyers trust us that the product they are going to buy is authentic, which is a real risk when you're buying something online."

Ross Hoffman during an event in Dubai, United Arab Emirates, on March 6, 2016. (Francois Nel/Getty Images for Dubai Lynx / Getty Images)

He said the growth in collectibles was also due to passion investing and nostalgia, as people don't want to invest in something that they can't feel and touch. He also said people are approaching collectibles from a finance angle, believing it to be a rare asset that they can sell for more in the future. The third reason is fantasy sports, which has exploded in popularity.

"Those are big, big trends that have grown a lot over the last 15 years that if you asked us, we think those are going to continue to grow over the next 10 years, and we think that that bodes well for us," Hoffman said.

NFL LEGEND MICHAEL IRVIN GETS INTO CRYPTO WORLD AS INVESTOR IN EDUCATIONAL PLATFORM

The company, which was acquired by Collectors last year, recently shattered records for auction sale prices, including the $2.46 million price tag for a LeBron James trading card, and nearly $500,000 for a Tom Brady game-worn jersey.

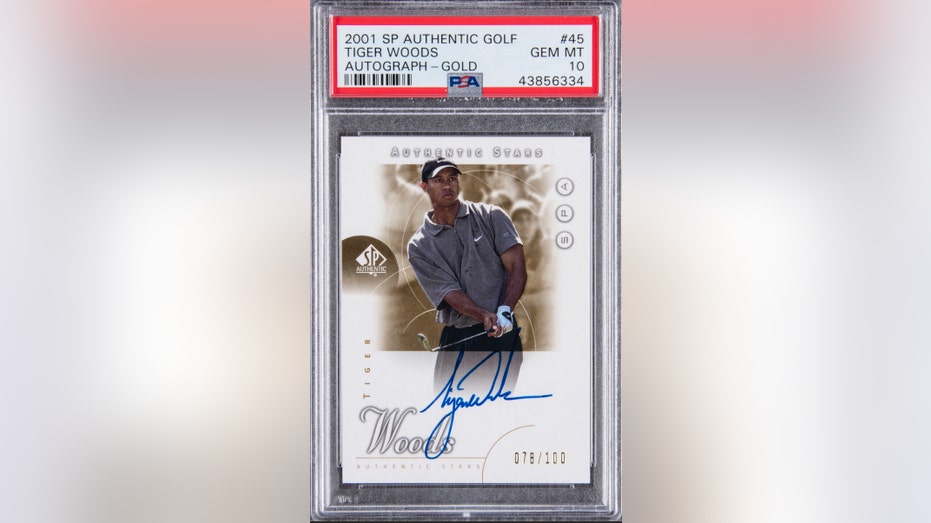

Last April, a Tiger Woods signed rookie card was sold at Goldin Auctions for $369,000. Woods was injured in a car crash that February, and he returned to the Masters last week for the first time since 2020.

Last year, a Tiger Woods signed rookie card was sold at Goldin Auctions for $369,000. (Goldin)

Amid the growing interest in collectibles, Goldin quadrupled its employee headcount and recruited a number of senior leaders from both startups and Fortune 500 companies. Goldin also created a new online marketplace, which improves the experience for collectors and makes sure the company doesn't have to rely on outside, third-party software.

"Over the last year, the technology we’ve implemented and the hires we’ve made have further solidified Goldin as the most trusted collectibles marketplace," said Hoffman. "Talented leaders from top companies have joined Goldin because they see the huge growth potential for this sector. We’re committed to continuing modernizing and scaling the business by providing next-generation tools and engaging content that will improve the experience for each and every collector."

Outside of sports, the collectibles market has grown due to an increase in popularity of video games and pop culture. Goldin says it recently expanded its auction offerings to include new video games and NFTs collectibles categories, while increasing its emphasis on pop culture items, like rare comic books.

A mural depicting superheroes and video games at the Goldin office in Runnemede, New Jersey. (Goldin)

Hoffman said a lot of people that collect sports cards have also played, or have a passion for video games.

"It's been just meeting the customers where they are," he said. "We knew there was more and more excitement around video games."

Hoffman said he got into trading cards and sports memorabilia the same way most kids in the U.S. did: Their mom or dad.

"For whatever reason people still hold on to this stuff. There are people that have moved all over the country … but they held on to their cards when they were a little kid and haven't thrown them out," Hoffman said. "There's a reason people haven't thrown this stuff out, [and] there's a reason they've held on to this stuff. It's a pretty powerful thing and that's what it was for me."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"As a kid who collected, never threw out any of the stuff … that’s still at my parent's house, that I’m now able to share with my son and daughter. To be able to work in that has been a thrill," he added.