TV consumers don’t want to pay more than $30 for streaming services

Three-quarters of U.S. consumers don’t want to pay more than $30 a month for streaming services, according to a new survey released by ad buyer resource, The Trade Desk, on Monday. Moreover, 59 percent of consumers said they don’t want to pay more than $20 a month.

The survey, which was conducted by YouGov and polled 2,613 U.S. adults between Nov. 19 and 21, could spell trouble for the several TV content providers jumping into the streaming game in 2020 if these findings are true.

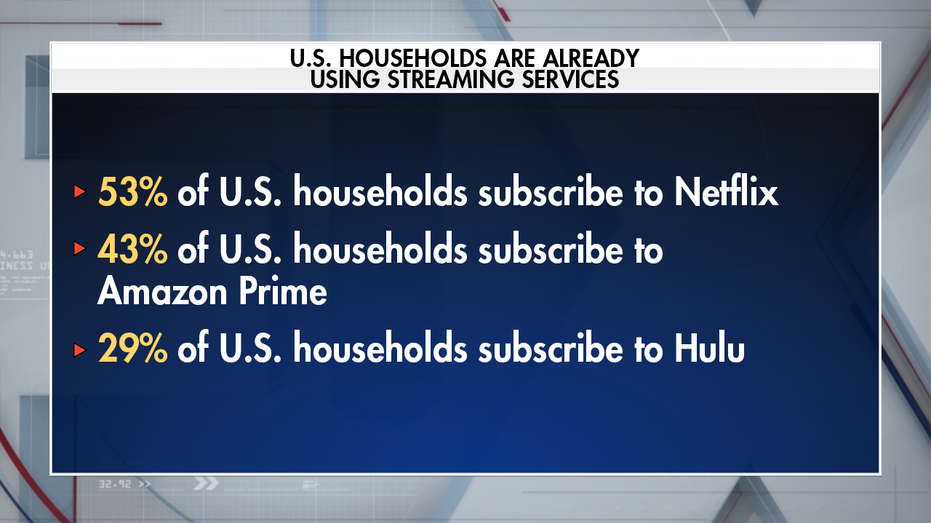

According to the survey, more than half of U.S. households are subscribed to Netflix while more than a third are subscribed to Amazon Prime and more than a quarter are subscribed to Hulu. With these three companies having such a stronghold on the market, it may be difficult to get consumers to shell out more cash.

WILL NETFLIX’S LIBRARY BE ENOUGH TO WIN THE STREAMING WARS?

For comparison’s sake, Netflix plans in the U.S. range between $8.99 and $15.99. Amazon Prime Video can either cost a monthly $8.99 or come with Amazon Prime’s $119 annual membership. Hulu plans are either $5.99 or $11.99 for standard and ad-free subscriptions, and if bundled with live TV, it can jump up to $54.99 or $60.99.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NFLX | NETFLIX INC. | 82.20 | +1.33 | +1.64% |

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

| DIS | THE WALT DISNEY CO. | 108.69 | +3.71 | +3.53% |

If a household was subscribed to the lowest plan out of the above streaming services, it would cost $23.97 a month, not accounting for tax, which leaves less than $6.03 for a potential fourth service under a strict $30 monthly budget.

THE CONSUMER BENEFITING FROM THE STREAMING WARS

The Trade Desk suggests that consumers are getting tired of subscribing to new platforms in light of rising streaming services such as Apple TV+ and Disney+ as well as upcoming services in 2020 such as AT&T TV, HBO Max and Peacock.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| T | AT&T INC. | 27.13 | -0.18 | -0.66% |

| CMCSA | COMCAST CORP. | 31.37 | +0.52 | +1.69% |

“With consumers experiencing subscription fatigue and unwilling to subscribe to more than one or two premium services, broadcasters have to figure out how to continue to fund this new golden age of TV,” said Brian Stempeck, a chief strategy officer at The Trade Desk.

AMC THEATRES GETS INTO STREAMING WARS

Discovery Inc., which is one of the many mass media companies releasing a streaming service this year, is positioned to be a competitor in the market. The company’s CEO David Zaslav has gone as far as to predict that only a few platforms will make it through the streaming wars, according to The Hollywood Reporter.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DISCA | NO DATA AVAILABLE | - | - | - |

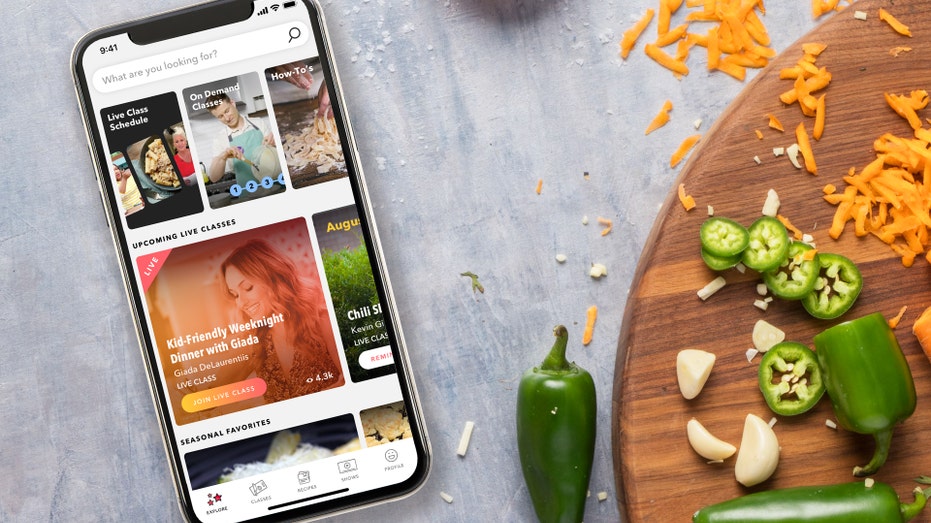

Even though he is confident that Discovery’s niched $6.99 monthly subscription under Food Network Kitchen will make the company a formidable force in the streaming world. Zaslav told FOX Business’ Liz Claman on the 2020 International Consumer Electronics Show floor Wednesday that Discovery’s Food Network Kitchen plan would be the “Peleton of food” with live and on-demand cooking classes, recipes and shopping.

He also cited Discovery’s generated free cash flow of over $3 billion, scale in Europe and knowledge that consumers are getting content outside of traditional cable bundles and free-to-air as reasons why its services are likely to succeed.

Food Network Kitchen is an app that provides hyper-interactive classes, on-demand video, Alexa support and more. (Food Network)

“We got to get our great content, whether it’s from Discovery, Animal Planet, ID, TLC, Oprah, HGTV, Food – we have to figure out how to get that not just to everyone that watches TV – but we got to get it on every device, everywhere in the world. That’s our mission,” Zaslav told Claman; which is a stark contrast to the limited strategy Sony employed in its now going defunct streaming service PlayStation Vue.

Discovery’s streaming venture will include tailored platforms for its brands like HGTV, TLC, Science Channel, OWN and more. The company will also partner with the BBC with licenses to the British media giant’s natural history programs such as “Planet Earth and “Blue Planet.” Additionally, Discovery and the BBC will debut a special series developed between the two networks.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

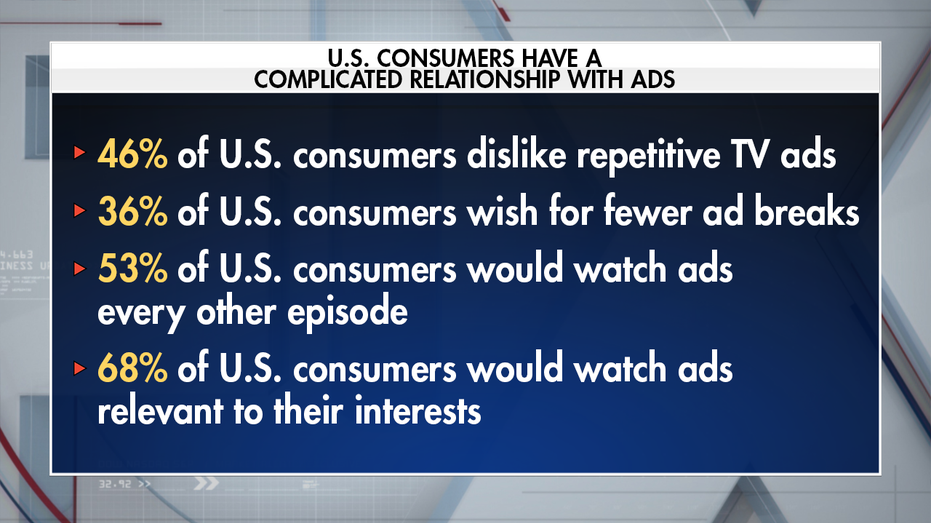

Going back to The Trade Desk’s survey, respondents indicated a willingness to endure advertisements if that meant it would cut their streaming expenses.

Nearly half of U.S. consumers said repetitive TV ads were a leading cause of frustration among streaming subscribers. More than one-third of respondents said they wish there were fewer ad breaks. However, more than half of respondents said they are willing to watch ads every other episode if it lowered their monthly costs on an ad-free device.

More than a third of respondents — 40 percent — would prefer to watch ads tailored to their interests and preferences. That number jumps up to more than two-thirds — 68 percent — if watching relevant ads meant seeing fewer ads overall.

CLICK HERE TO READ MORE ON FOX BUSINESS

Stempeck alleges that the survey’s collected responses will shape how the streaming market evolves.

"This indicates that ads will fund the future of streaming TV, and that broadcasters and advertisers have an opportunity to improve the advertising experience in a way that simply is not possible with traditional, linear TV," Stempeck said.