Why America doesn’t have enough EV charging stations

Gas stations spar with utility companies, rural areas predict years of losses on chargers, spotty equipment threatens reliability: The U.S. EV charging network is a mess.

Beam Global's EV Arc requires zero ground construction, electrical work

Beam Global CEO Desmond Wheatley explains the cleantech developer's zero-emission, solar-powered electric vehicle charger on 'The Claman Countdown.'

One of the biggest roadblocks to the mass adoption of electric vehicles is the troubled business model for the commercial chargers that power them.

The government is pouring billions of dollars into developing a national highway charging network. But businesses aren’t sure how they will make money, and the nascent industry looks messy.

Utility companies and gas stations are at war with each other over who will own and operate EV chargers. Rural states say some charging stations could operate at a loss for a decade or more. New companies that provide charging gear and services are contending with the equipment’s spotty reliability.

The network’s build-out has a chicken-or-egg quality: EV advocates say many drivers will only be comfortable purchasing vehicles if rapid charging is as easy as using a pump at a gas station. Yet businesses interested in offering charging say they can’t make money until more EVs are on the road.

Around 1% of U.S. drivers own EVs, but wait lists are growing and auto makers including General Motors Co. and Ford Motor Co. are expecting EV sales to keep rising. To overcome "range anxiety" — the fear that EV drivers will run out of power while traveling long distances — industry experts say the U.S. needs plentiful fast chargers. Fast charging can take 20 minutes to an hour depending on the vehicle.

EV market leader Tesla Inc. built a private U.S. network of nearly 16,000 fast chargers for its own drivers starting in 2012. (iStock / iStock)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 84.24 | +0.94 | +1.13% |

| F | FORD MOTOR CO. | 13.80 | +0.08 | +0.58% |

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

TESLA PLANS TO COMBINE DINER, DRIVE-IN MOVIE THEATER WITH ELECTRIC VEHICLE CHARGING STATIONS

There are more than 145,000 places to refuel a gas-powered vehicle. So far, the U.S. has 11,600 points where any EV can charge quickly, according to the research group Atlas Public Policy.

EV market leader Tesla Inc. built a private U.S. network of nearly 16,000 fast chargers for its own drivers starting in 2012, and its popular Superchargers have become a marketing tool for selling cars. Most other automakers are relying on the government and private companies. In some cases, they are investing alongside charging companies.

The Biden administration and Congress want to speed the transition to electricity-as-fuel. This year’s climate and tax law, known as the Inflation Reduction Act, offers expanded federal tax credits to persuade more businesses to add chargers. Budget estimators expect around $1.7 billion in tax credits for chargers or other alternative-fuel equipment to be claimed over a 10-year period. States also are set to distribute $7.5 billion over several years from last year’s infrastructure law to increase the availability of chargers.

President Joe Biden signs into law H.R. 5376, the Inflation Reduction Act of 2022 (climate change and health care bill) in the State Dining Room of the White House on Tuesday August 16, 2022. From left, Sen. Joe Manchin (D-W.VA), Senate Majority Lead (Demetrius Freeman/The Washington Post via Getty Images / Getty Images)

USED EVS STILL TOO EXPENSIVE COMPARED TO GAS, DIESEL VEHICLES: REPORT

Tension has erupted between businesses such as gas stations, convenience stores and truck stops and utility companies over who gets to sell electricity to drivers and who foots the bill for the costly infrastructure to do so.

Many monopoly utilities want to own and operate chargers, extending the way electricity sales into a new market. They have a competitive edge because, with the approval of state utility regulators, they can pass on the cost of infrastructure and power to all rate payers, as they do for wires or new power generation.

In Minneapolis, Channing Smith, who owns a gas station and convenience mart called The Corner Store, said a utility proposal threatens to squeeze out charging competition. Xcel Energy has asked regulators to let it build, own and operate 730 fast charging sites by 2026 — about 45% of Minnesota’s’ projected fast-charging market. The $193 million cost would be paid for by its rate payers.

"For them to take taxpayer money to create a network removes the private sector completely," Mr. Smith said. He said he would like to install fast chargers, but not if he has to compete directly against the company selling him electricity.

Xcel says a dearth of public chargers is hindering EV adoption in Minnesota, which has just 55 or so non-Tesla locations for fast charging, according to government data. "We have not seen the market fill in key gaps regarding necessary public charging," Xcel told regulators in August.

Lacey Nygard, an Xcel spokeswoman, said the company would support retailers or communities whether they wanted to own or simply host chargers on their property.

Tim Echols, an EV advocate and a Republican who serves on Georgia’s utility commission, said utilities will have to own and operate some equipment.

"If it’s going to be in an area that’s never going to make money, then who else is going to put it there?" Mr. Echols asked.

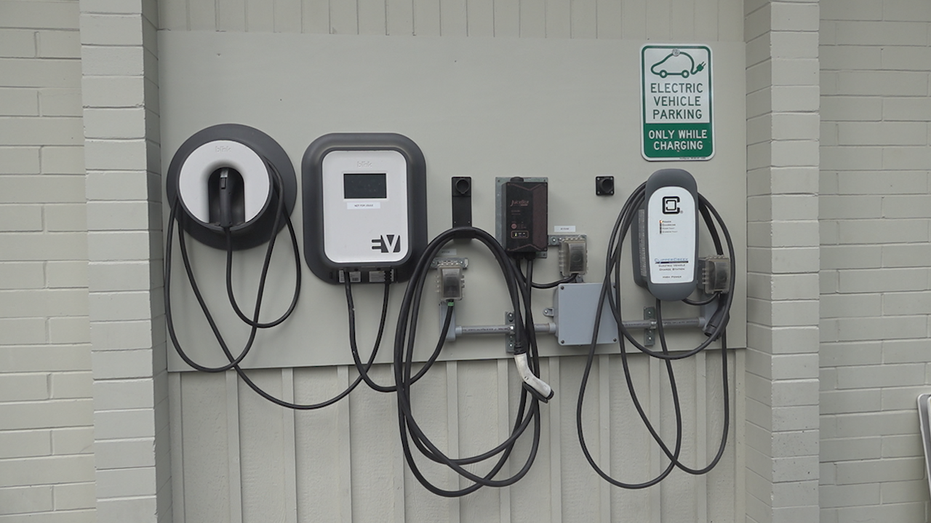

The charging station for electric vehicles at Park West and Mobility Works. (FOX Business / Fox News)

ELON MUSK RIPS 'ENVIRONMENTAL, SOCIAL, AND GOVERNANCE' SCORES: 'THE DEVIL'

In the past year, utilities have been approved or have pending requests to spend more than $1.4 billion on charging, according to Atlas Public Policy.

Another point of contention comes in how utilities charge businesses for electricity. The highest 15-minute period of power consumption each month makes up a large chunk of commercial billing. Because an EV charging session requires a surge of power, gas station owners say their monthly bills are spiking unpredictably, by hundreds or even thousands of dollars.

Shameek Konar, chief executive of Pilot Co., which has more than 800 truck stops and travel centers across North America, said he understands the need for such fees, which pay for upgrades to electric infrastructure. But Pilot expects chargers to draw twice as much power as the rest of a truck stop. He said he thinks high fees should be phased in, and that state or federal officials should help set common rates with the patchwork of America’s nearly 3,000 utilities.

Pilot and GM plan to add fast-chargers at 500 of the travel center company’s Pilot and Flying J locations starting next year.

"We’re going to have to work with 300 utilities to come up with rate structures," Mr. Konar estimated.

Gas prices over $7.00 a gallon are displayed at a Chevron gas station on Oct. 3, 2022 in Mill Valley, Calif. Gas prices continue to surge in California with the average price for regular unleaded at $6.25 on Monday compared to the national average of (Justin Sullivan/Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

| COP | CONOCOPHILLIPS | 107.62 | +2.64 | +2.51% |

America’s vast network of gasoline stations had a century to mature.

At the turn of the 20th century, gas was sold on the shelf in hardware and grocery stores, and later from above-ground tanks from which a worker might fill a bucket to pour into a car’s tank with a funnel, said Matt Anderson, curator of transportation at the Henry Ford Museum of American Innovation in Dearbon, Mich.

Pumps that would be familiar to today’s drivers arrived around 1915, but were mostly available at mom-and-pop shops. It wasn’t until national chains and multinational oil companies entered the business as automobile ownership increased, establishing gasoline brands such as Texaco and Conoco, that stations spread across the country.

In 1920, the U.S. had 15,000 gas stations, according to John Lienhard, emeritus professor of mechanical engineering and history at the University of Houston. By 1930, when there were 23 million automobiles on the road, the number of stations had topped 100,000.

The EV charging industry, including billing fights, patchy reliability and lack of service in rural areas, has parallels in telecommunications and the installation of wires, fiber optic cables and cellphone towers across the U.S., said Rob Frieden, emeritus professor of telecommunications and law at Penn State University.

"When you’re dealing with infrastructure, you’ve got very high fixed costs that have to be sunk in terms of investment before the first dollar of revenue accrues," Mr. Frieden said. "This stuff is expensive, and it involves real estate, retrofitting real estate and interfaces with the electrical grid."

Government infrastructure spending was essential to the rapid adoption of internet use and cellphones and smartphones, Mr. Frieden said. It helped largely eliminate problems such as spotty cell coverage and roaming charges in a matter of about six years. In 2000, roughly 1% of Americans had home broadband, but by 2010 more than 60% did, according to the Pew Research Center.

CLICK HERE TO READ MORE ON FOX BUSINESS

Still, getting faster internet to rural homes remains a challenge. As of last year, 79% of suburban homes had fast internet service compared with 72% of rural homes, according to Pew.

Many rural power providers are wondering who, if anyone, will want to build and operate chargers along their most remote roadways.

Wisconsin’s Dairyland Power Cooperative told the Biden administration in August that sparsely used chargers in the northern part of the state would likely "operate at a loss for years" and that rural areas need flexibility in planning.

Maine officials said the operation of some sites may need government subsidies because they won’t turn a profit for a decade. Wyoming estimates that no rural charging station built to the requirements the federal government expects — four chargers placed every 50 miles along highways — would be profitable until the 2040s.

Stations will "likely struggle to be economically viable in population centers in the state, let alone in extremely rural areas," said Luke Reiner, Wyoming’s transportation director.

In Utah, the number of Garkane Energy Co-Op Inc.’s 15,000 members who own EVs can be counted on "fingers and toes," said Chief Executive Dan McClendon.

The company wants tourists at national parks such as the Grand Canyon to be able to charge to help its economy, Mr. McClendon said. But fast charging sessions in some areas could equal the amount of power being used by residents, creating challenges to balance power demand and supply, he said.

Remote spots also face hurdles to keep equipment running. When chargers break, service technicians could have a three-hour drive from Las Vegas, Mr. McClendon said.

Electric cars are parked at a charging station in Sacramento, Calif., April 13, 2022. Pilot and GM plan to add fast chargers at 500 of the travel center company’s Pilot and Flying J locations starting next year. (AP Photo/Rich Pedroncelli, File / AP Newsroom)

The Biden administration will require that equipment receiving public funds is working and available for use at least 97% of the time. Studies indicate an uphill climb for the non-Tesla charging industry to comply.

Equipment is often on the fritz. Communications can break down between the car and the charger, the charger and the company operating the charging network, and with payment systems. On occasion, a wasp crawls into the gear and builds a nest. Vandals can strike, sticking gum in the credit card readers and bashing the machines.

A J.D. Power driver study released in August found that one out of every five owners don’t ultimately charge when they try to do so. A 2022 study led by the University of California Berkeley tested all 657 public EV fast chargers in the greater San Francisco Bay Area and found more than a quarter didn’t work.

"We need to do better as an industry making sure that every time you walk up to a charger, it works," said Jonathan Levy, chief commercial officer at charging network EVgo Inc.

The risk for car makers is that early adopters will tolerate inconvenience, but the mass market won’t.

CLICK HERE TO GET THE FOX BUSINESS APP

"I’ll drive to the next charger if it’s not working because I’m committed to the technology," said Spencer Reeder, Audi of America’s director of government affairs and sustainability. "There’s going to be missteps, these are early days. We understand that. But I think we can’t afford too many."