US pending home sales tumble 20% in June as mortgage rates surge

Economists expected monthly sales to drop by 1.5%

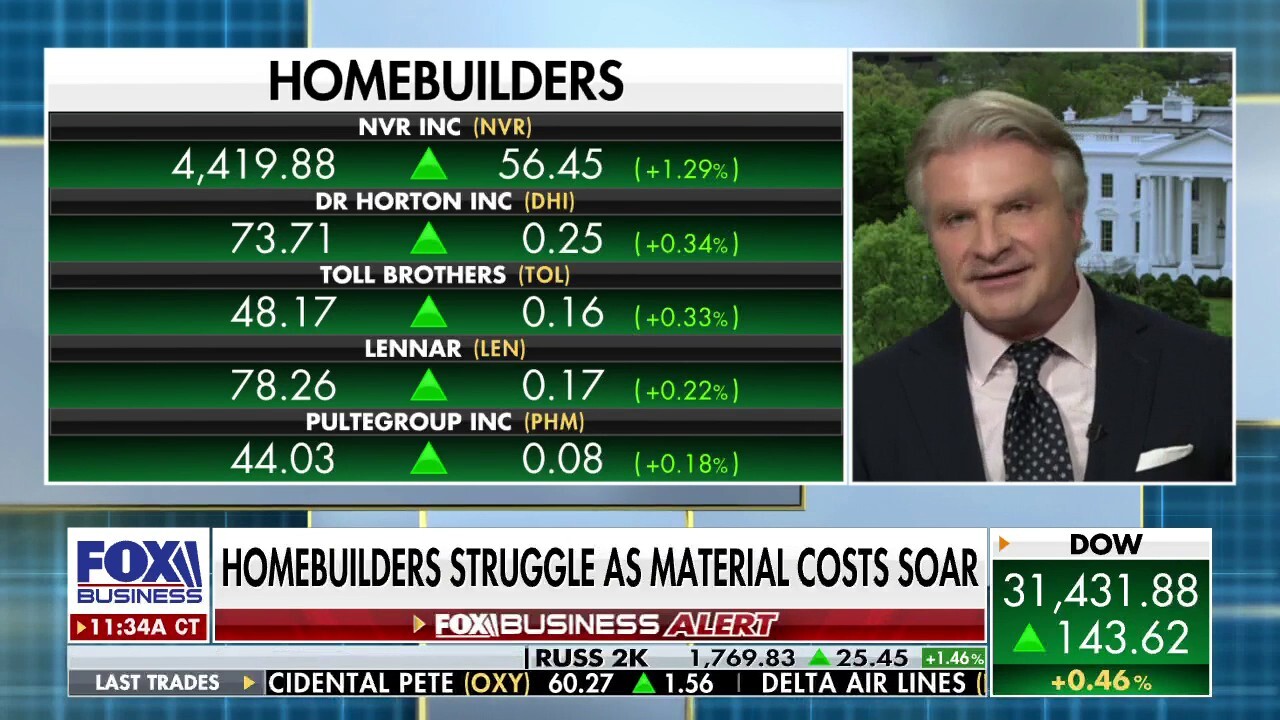

Real estate consultant on housing market: 'Everything costs more'

Tom Rood, SitusAMC Managing Director, discusses the increased costs of building a home and buying in the current real estate market

Signed contracts to buy previously owned homes in the U.S. plunged more than expected in June as rising mortgage rates and higher home prices continued to push entry-level homebuyers out of the market.

The National Association of Realtors said on Wednesday that its pending home sales index tumbled 20% in June compared with the same month one year ago. On a monthly basis, pending home sales dropped 8.6% – far more than the 1.5% decline projected by Refinitiv economists.

The interest rate-sensitive housing market has started to cool noticeably in recent months as the Federal Reserve moves to tighten policy at the fastest pace in three decades in order to cool consumer demand and bring scorching-hot inflation under control.

Policymakers already approved a 75-basis point rate increase in June and are expected to approve another of that magnitude on Wednesday at the conclusion of their two-day, policy-setting meeting. That would push the benchmark federal funds rate to a range between 2.25% and 2.50%, the highest since the COVID-19 pandemic began two years ago.

HOUSING STARTS IN JUNE PLUNGE TO LOWEST LEVEL IN 9 MONTHS

Houses in the Harris Ranch community of Boise, Idaho, US, on Friday, July 1, 2022. (Jeremy Erickson/Bloomberg via Getty Images / Getty Images)

Following the rate hikes, the average rate on a 30-year fixed mortgage – the most popular among new homeowners – climbed to nearly 6% in June, though they've since moderated. The average rate for a 30-year fixed rate mortgage is currently hovering around 5.54%, according to recent data from mortgage lender Freddie Mac.

That is significantly higher than just one year ago, when rates stood at 2.88%.

Combined with high home prices, the rapid rise in borrowing costs has pushed many entry-level homebuyers out of the market.

WASHINGTON, April 29, 2020.A man wearing a mask walks past the U.S. Federal Reserve building in Washington D.C., the United States, on April 29, 2020. The U.S. Federal Reserve on Wednesday kept its benchmark interest rate unchanged at the record-low ((Xinhua/Liu Jie via Getty Images) / Getty Images)

CLICK HERE TO READ MORE ON FOX BUSINESS

A new report from Redfin last week showed that the share of sale agreements on existing homes canceled in June was just under 15% of all homes that went under contract – the highest since early 2020 – at the height of the COVID-19 pandemic.