Dow falls below 23K as Nasdaq nears bear market

U.S. shares tumbled on Thursday with the Dow Jones Industrial Average falling nearly 500 points or about 2 percent and sliding below 23,000 for the first time in 14 months. Along with the blue-chip index, the tech-heavy Nasdaq Composite also plummeted, now flirting with bear market territory. The Nasdaq and the S&P 500 lost over 1 percent during the session. At the same time, volatility spiked to the highest level since February.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

The selling accelerated after President Trump told House Republican leaders Thursday he will not sign a Senate-passed spending package that does not include sought-after border security funds, upending negotiations to avert a government shutdown by the end of the week as reported by Fox News.

House Speaker Paul Ryan, R-Wis., and House Majority Leader Kevin McCarthy, R-Calif., told reporters after meeting the president at the White House that Trump told them he will not sign the stopgap spending measure approved by the Senate Wednesday night because of “legitimate concerns for border security.”

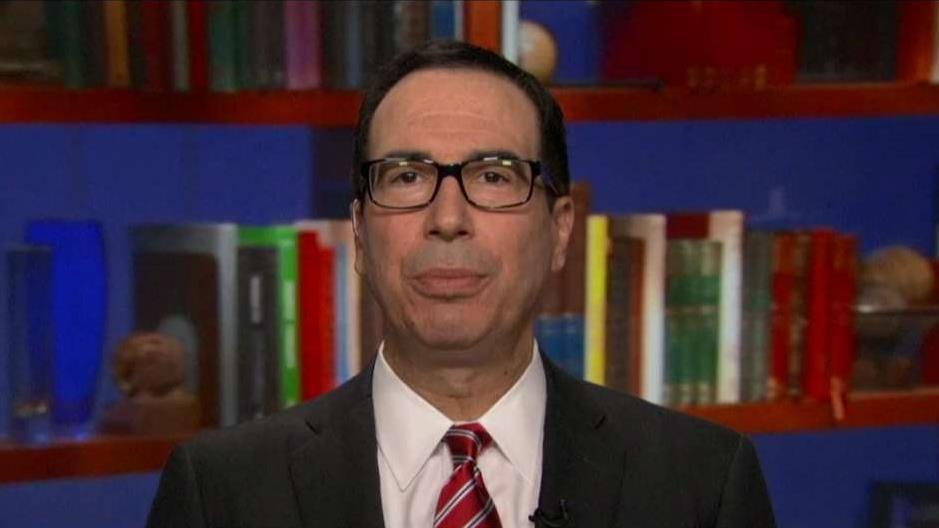

The negative sentiment carried over from Wednesday after the Federal Reserve raised interest rates for a fourth time. On Thursday, mid-morning Treasury Secretary Steven Mnuchin told FOX Business that the market selloff in reaction to the Fed’s rate-hike decision was “completely overblown.” “I think that the market was disappointed in the Chairman’s comments,” he said during an exclusive interview with Stuart Varney on Thursday. Mnu

More than one-quarter of Dow components, shares of eight major American corporations, were hitting 52-week lows. Some of these companies, whose fundamentals remain strong, could prove to be buying opportunities. We are getting “to levels that make a lot of sense” said Hugh Johnson, of Hugh Johnson Advisors, during an interview on FOX Business’ “Countdown to the Closing Bell.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

| TRV | THE TRAVELERS COS. INC. | 301.42 | +1.16 | +0.39% |

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

| UTX | NO DATA AVAILABLE | - | - | - |

| HD | THE HOME DEPOT INC. | 385.25 | +3.34 | +0.87% |

| IBM | INTERNATIONAL BUSINESS MACHINES CORP. | 298.93 | +9.04 | +3.12% |

| DWDP | NO DATA AVAILABLE | - | - | - |

Crude oil prices extended recent losses, falling to the $46 per gallon barrel level. For some oil watchers, falling crude is a negative future indicator for the global economy.

On Friday, investors will get a check on U.S. economic growth with an update on third quarter GDP which was holding at 3.5 percent as of the last update.

FOX Business' Ken Martin and Mike Obel contributed to this report.