Housing, earnings reports due, cuts in healthcare and more: Tuesday's 5 things to know

The home prices report is expected to show a drop of 0.7%, the sixth-straight month of declines, but improvement over July's 0.8% fall

Housing is in 'trouble': Mitch Roschelle

Macro Trends Advisors founding partner Mitch Roschelle argues the housing market is slowing down 'dramatically.'

Here are the key events taking place on Tuesday that could impact trading.

HOUSING REPORTS DUE: Reports on home prices and the mood of consumers are slated for release Tuesday morning.

At 9 a.m. ET, we’ll get our first look at home prices for August from S&P CoreLogic Case-Shiller.

The non-seasonally adjusted 20-city index is expected to fall 0.7%, the sixth straight monthly decline but a slight improvement from July’s 0.8% slide, which was the largest monthly tumble in more than 10 years.

FLORIDA COASTAL LIVING RESHAPED BY HURRICANE HOUSING CODES

A view of a townhome for sale in Huntington Beach, listed at $1,100,000 Friday, April 22, 2022. (Allen J. Schaben / Los Angeles Times via Getty Images / Getty Images)

For the year, home-price growth as measured by the 20-city index is expected to jump 14.4% annually in August. That’s a large spike to be sure, but it would be the fourth month in a row of slower growth, down from a record 21.3% in April, and the smallest annual gain since March 2021.

At 10 a.m. ET, the Conference Board will release its consumer confidence index for October.

It’s expected to fall a point-and-a-half to 106.5, after rising more than expected in September to the highest since April on rising wages and falling gas prices.

Confidence is down sharply from a post-pandemic high of 128.9 in June of last year on inflation concerns.

CORPORATE EARNINGS: A busy day ahead for earnings news, with four Dow members scheduled to report – Coke and 3M in the morning; Microsoft and Visa after the close.

Ahead of the opening bell we’ll hear from automaker General Motors, industrial conglomerate General Electric, oil and gas refiner Valero Energy, health insurer Centene, package delivery giant UPS (how is it doing ahead of the all-important Christmas shopping season?), aerospace and defense heavyweight Raytheon Technologies, and homebuilder Pulte Group to name a few.

Coca-Cola

Alphabet and Dow member Microsoft will headline the festivities after the closing bell. Microsoft is expected to say fiscal first-quarter earnings-per-share rose 1.4% from a year ago to $2.30 on a 9.5% jump in revenue to $49.61 billion. Microsoft breaks down its operations into three main segments: Intelligent Cloud (Azure, SQL and Windows servers), More Personal Computing (Windows, Xbox, Surface and PC accessories) and Productivity & Business Processes (Office 365, Skype, LinkedIn).

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MMM | 3M CO. | 165.13 | +0.95 | +0.58% |

| MFST | NO DATA AVAILABLE | - | - | - |

| V | VISA INC. | 318.89 | -1.42 | -0.44% |

| GM | GENERAL MOTORS CO. | 81.47 | -2.20 | -2.63% |

| GE | GE AEROSPACE | 334.60 | +5.15 | +1.56% |

| VLO | VALERO ENERGY CORP. | 199.24 | -0.22 | -0.11% |

| CNC | CENTENE CORP. | 43.68 | +0.62 | +1.44% |

| UPS | UNITED PARCEL SERVICE INC. | 115.52 | -0.57 | -0.49% |

As for Alphabet, the online search and ad giant is expected to say third quarter earnings-per-share fell 11% from a year ago to $1.25, with revenue rising 8.4% to $70.61 billion (including expected traffic acquisition costs of $12.35 billion).

Here are revenue targets for two of Alphabet’s key operating segments: Google Services at $64.58 billion and Google Cloud at $6.70 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| RTX | RTX CORP. | 205.20 | +0.39 | +0.19% |

| PHM | PULTEGROUP INC. | 139.58 | -2.50 | -1.76% |

| TXN | TEXAS INSTRUMENTS INCORPORATED | 218.05 | -5.27 | -2.36% |

| CB | CHUBB LTD. | 329.08 | +0.03 | +0.01% |

| CMG | CHIPOTLE MEXICAN GRILL INC. | 37.97 | -0.75 | -1.94% |

| MAT | MATTEL INC. | 17.42 | +0.14 | +0.81% |

In the afternoon, also watch for results from chipmaker Texas Instruments, property and casualty insurer Chubb, credit card-payment processor Visa (investors will want to know if inflation and Fed rate hikes are cutting into consumer spending), Mexican fast-casual chain Chipotle, and toymaker Mattel among others.

Just over one-fifth of the S&P 500 (106 companies) have reported so far.

MARKET REPORT: U.S. stocks gained on Monday as investors focused on encouraging signs from corporate earnings and hopes that the Federal Reserve would slow the pace of interest-rate increases.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 49395.16 | -267.50 | -0.54% |

| SP500 | S&P 500 | 6861.89 | -19.42 | -0.28% |

| I:COMP | NASDAQ COMPOSITE INDEX | 22682.729157 | -70.91 | -0.31% |

The Dow Jones Industrial Average climbed 417.06 points, or 1.3%, to 31499.62, its highest closing level in six weeks. The S&P 500 advanced 44.59, or 1.2%, to 3797.34. The technology-heavy Nasdaq Composite rose 92.90, or 0.9%, to 10952.61, bouncing back after it started the day in the red.

Last week, the Dow notched its best three-week stretch since November 2020, offering investors a reprieve from the selling pressure that has whipsawed portfolios this year.

The rally was kicked off, in part, by a batch of corporate earnings – particularly from banks and airlines – that offered an encouraging outlook on the U.S. economy.

ELON MUSK SAYS HE'S 'OBVIOUSLY OVERPAYING' FOR TWITTER BUT TOUTS PLATFORM'S 'INCREDIBLE POTENTIAL'

Traders work on the floor of the New York Stock exchange during morning trading on October 18, 2022, in New York City. (Michael M. Santiago/Getty Images / Getty Images)

Stocks then raced higher on Friday after The Wall Street Journal reported that Fed officials are likely to consider the possibility of shifting to smaller interest-rate increases in December.

"Market participants are desperately looking for a Fed pause or pivot," said Chris Senyek, chief investment strategist at Wolfe Research.

Still, he cautioned that such hopes would likely be dashed by continuing high inflation and low unemployment, which would pressure the central bank to maintain its hawkish stance.

"We think a Fed pause is a long ways off," Senyek said. Investors are looking ahead to a busy week of earnings results.

JOB CUTS LOOMING: Royal Philips NV announced on Monday it will cut 4,000 jobs worldwide as it battles several economic headwinds including fallout related to the recall of its sleep apnea machines.

Roy Jakobs, who took over as CEO of the Dutch health care technology giant earlier this month, said in a statement the company faces "multiple challenges" and its "Q3 2022 performance reflects this."

"My immediate priority is therefore to improve execution so that we can start rebuilding the trust of patients, consumers and customers, as well as shareholders and our other stakeholders," Jakobs continued, adding that "this includes the difficult, but necessary decision to immediately reduce our workforce."

The cuts amount to about 5% of the company's 80,000 jobs.

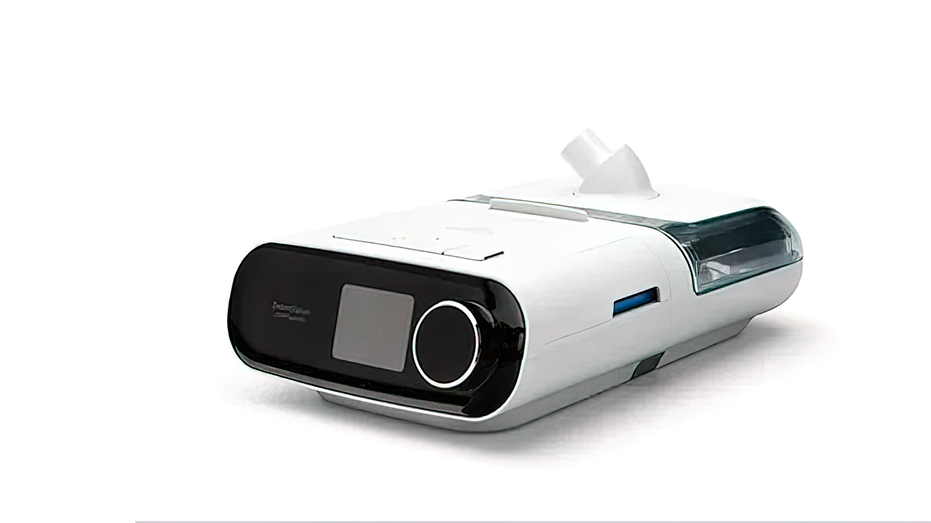

FDA ISSUES WARNING OVER PHILIPS BREATHING MACHINE RECALL

Jakobs said the cuts are necessary to help "start turning the company around in order to realize Philips’ profitable growth potential and create value for all our stakeholders," he added.

The company suffered huge losses after recalling sleep apnea machines last year because the foam inside the devices posed a health risk, including toxic and carcinogenic effects.

DreamStation ASV, also known as DreamStation BiPAP autoSV. (Philips Respironics )

Philips sold millions of such machines worldwide and said it is taking a 1.3-billion euro hit in the third quarter for "the impairment of goodwill" of the subsidiary that makes them.

ECONOMIC SPIN: Economic policy experts criticized the White House on Monday for attempting to spin the latest economic indicators despite rising inflation and widespread consumer angst.

On Monday, Ron Klain, the White House chief of staff, tweeted that there was a lot of "noise" about the economy, but that the reality was much different. His tweet came in response to a report from Goldman Sachs pegging the likelihood of a recession occurring in the next 12 months at 35%, lower than the consensus 63% odds.

Klain also retweeted a post Sunday from Dean Baker, the co-founder of the left-wing think tank Center for Economic and Policy Research, suggesting that the economy was strong because of the low unemployment rate.

"The broader point is, again, prices are up 13% since President Biden was inaugurated in January 2021 and wages have gone up by just half of that," said Brian Riedl, an economist and senior fellow at the Manhattan Institute. "You can't spin your way out of rising prices, falling real wages and declining stock values."

YELLEN SAYS INFLATION REMAINS BIDEN'S NO. 1 PRIORITY AS DEMOCRATS FACE ELECTION ONSLAUGHT

Ron Klain, White House chief of staff, listens during a cabinet meeting with U.S. President Joe Biden at the White House in Washington, D.C., U.S., on Tuesday, July 20, 2021. (Al Drago/Bloomberg via Getty Image / Getty Images)

"There's no set of talking points, rhetoric, speeches or retweets that's going to alter what Americans see they're paying every day at the pump and at the grocery store," he continued. "The White House just sees this as a communications problem while actively making the problem worse with policies that worsen inflation."

The Consumer Price Index, a key measure of inflation, surged 8.2% year-over-year in September, according to the Department of Labor, coming in hotter than expected. Energy prices ticked up 19.8% and food prices increased 11.2% on an annual basis last month.

CLICK HERE TO READ MORE ON FOX BUSINESS

While the U.S. added 263,000 jobs and the unemployment rate declined to 3.5% last month, the labor force participation rate, which measures the percentage of working-age adults working or looking for work, has remained low, according to Federal Reserve data.

The labor force participation rate came in at 62.3% in September, compared to its pre-pandemic level of 63.4%.