Dow craters 500+ points on CPI jump, 10-year Treasury yield hits 2.02%

Disney shares closed up 3%+ after adding nearly 130M + subscribers

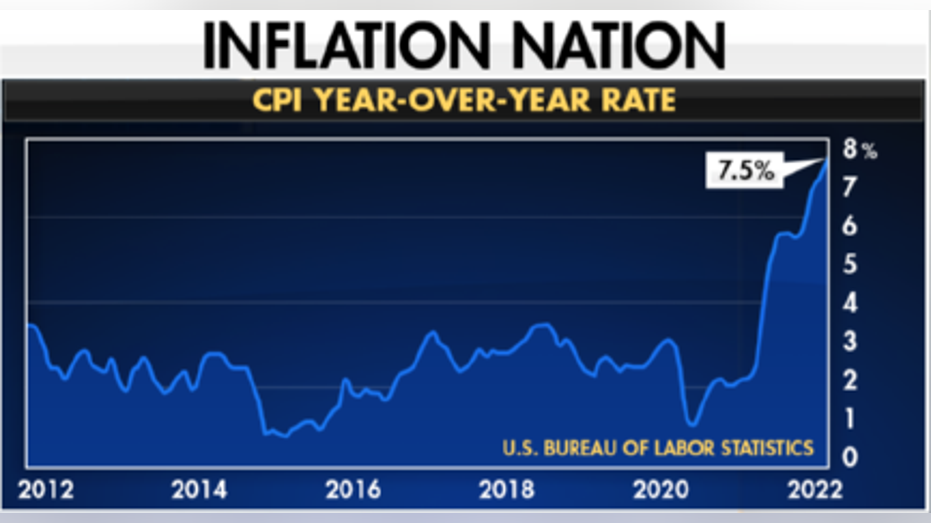

U.S. inflation hits 40-year high after jumping 7.5 percent in January

U.S. inflation rose 7.5 percent in January, the highest since February 1982. FOX Business Ed Lawrence with more.

Selling of U.S. stocks accelerated in the final hours of trading after inflation rose more than expected to the highest level since 1982, pushing bond yields up. This as St. Louis Federal Reserve President James Bullard suggested rates should be one full percentage point higher by July.

The Dow Jones Industrial Average fell over 500 points or 1.5%, while the S&P 500 and Nasdaq Composite fell 1.8% and 2.1%, respectively.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

Semiconductor stocks weighed on the Nasdaq with AMD, Nvidia and Texas Instruments falling.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMD | ADVANCED MICRO DEVICES INC. | 208.44 | +15.94 | +8.28% |

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

| TXN | TEXAS INSTRUMENTS INCORPORATED | 221.44 | -2.54 | -1.13% |

The consumer price index on a year-over-year basis rose 7.5%, more than expected and the highest in nearly 40 years. Month-over-month it rose 0.6%, matching December. If you factor out volatile food and energy costs, the core consumer price index rose 0.6% for the month. On an annual basis, core CPI jumped 6%.

10-year Treasury yield hits 2.02%

The 10-year Treasury yield touched 2% for the first time since July 2019.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In earnings, Disney rose after strong quarterly results. Additionally, Disney+ subscribers reached just under 130 million, sending shares up 3.3% even in a down market.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 108.69 | +3.71 | +3.53% |

Another Dow member, Coke, saw shares tick higher after posting better than expected quarterly results; Pepsi also blew past estimates, but shares ended lower. Each warned about the impact of higher prices in the current quarter.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KO | THE COCA-COLA CO. | 79.03 | +0.52 | +0.66% |

| PEP | PEPSICO INC. | 170.49 | +2.96 | +1.77% |

In other earnings, Twitter shares gave back gains ending lower after the social media giant announced a $4 billion buyback program. Still, ad revenue for the quarter and user growth fell short of expectations.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TWTR | NO DATA AVAILABLE | - | - | - |

Affirm shares stumbled after reporting its adjusted operating loss for the fiscal second quarter was $7.9 million, compared to an adjusted operating income of $3.1 million in the same period a year ago.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AFRM | AFFIRM HOLDINGS INC. | 57.03 | -2.39 | -4.02% |

INFLATION PROBABLY ACCELERATED IN JANUARY TO ANOTHER 40-YEAR HIGH

Separately, the Labor Department reported unemployment benefits for last week, jobless claims, were 223,000 down from 238,000 the previous week. Continuing claims, which track the total number of unemployed workers collecting benefits, were 1.62 million, still below pre-pandemic levels.

In the afternoon watch for results from real estate marketplace Zillow and travel shopping firm Expedia Group.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| Z | ZILLOW GROUP INC. | 54.97 | +0.96 | +1.78% |

| EXPE | EXPEDIA GROUP INC. | 236.85 | +5.55 | +2.40% |

Bitcoin remained around $43,000.

CLICK HERE TO READ MORE ON FOX BUSINESS

In energy trading, benchmark U.S. crude closed at $89.88 per barrel.

The Associated Press contributed to this report.