SunTrust, BB&T $66B deal creates Truist, CEO talks future

Truist is now the nation's sixth largest bank

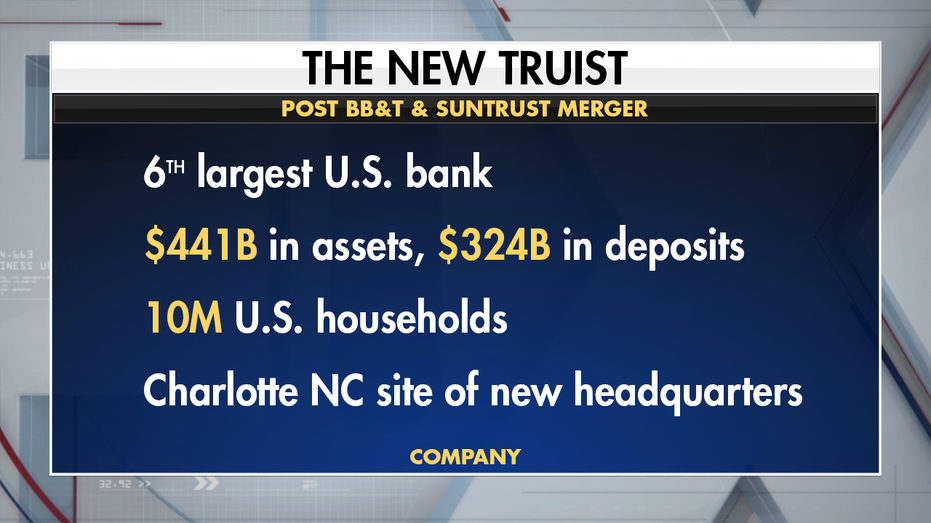

Truist, now America's sixth largest bank, is open for business Monday following the regulatory approval of BB&T's $66 billion combination with SunTrust.

For BB&T CEO Kelly King, the priority is to keep those regional values, while upping the banks' technology profile.

IF CHARLES SCHWAB, TD AMERITRADE DEAL FAILS BIG FEE TO BE PAID

"We are going to be a large bank in terms of the capabilities that we offer. We will be a small bank in terms of meeting you face-to-face as a consumer," King told FOX Business.

"We're going to be your closest financial friend when you need us up close," he added, and when customers want to bank with straight technology, they'll have that option as well.

AMERICA IN TROUBLE IF BIG TECH ABANDONS PENTAGON: BEZOS

Those large bank capabilities will be what will become a souped-up technology financial institution, which King revealed partly helped shape his vision of BB&T's next chapter.

"About five years ago there was a sea change where the American public shifted to what I call demand for real-time satisfaction. And in so doing so they demanded a whole new level of interaction between touch and technology."

The newly combined bank will serve 10 million U.S. households across eight states primarily in the Southeast and Texas with $441 billion in assets and $324 billion in deposits. Charlotte, North Carolina, will be the site of a new headquarters.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TFC | TRUIST FINANCIAL CORP. | 55.81 | +0.67 | +1.22% |

The stock will trade on the New York Stock Exchange under the ticker TFC and will have about 60,000 "teammates" according to King. Top among those is Bill Rogers, SunTrust's former CEO, who will serve as president and chief operating officer ahead of succeeding King as CEO in September 2021.

Over the next few weeks, the two will embark on a series of town hall meetings to talk to employees and spread the mission of the new financial institution. They'll also be finalizing key decisions about technology spending which will amount to about $100 million off the bat, which is on top of what has already been allocated.

There will also be a consolidation of branches, which in some cases may be the closing of smaller branches to make way for a combined bigger one. The BB&T SunTrust deal, first announced in February, is the first major bank merger since the financial crisis, but King believes there will be more consolidation because technology is moving so fast.

CLICK HERE TO READ MORE ON FOX BUSINESS

"Either companies have to combine to get the national scale of being a larger company or they’ve got to figure out some way to create cooperaties or something...the smaller you are the more challenging it is to meet the scale," he said.