Dow tanks 1,861 points as stocks post worst session since March

45M Americans have lost their jobs amid the COVID-19 pandemic

U.S. equity markets plunged Thursday with the selloff accelerating in the final hour of trading as investors reacted to a resurgence in COVID-19 infections as more states reopened and also after the Federal Reserve warned of a slower economic recovery.

The Dow Jones Industrial Average fell 1,861 points or 6.9 percent, the fourth worst one-day point drop on record. The S&P 500 and the Nasdaq Composite sank 5.89 percent and 5.27 percent, respectively. The selling marked the sharpest one-day decline for the major averages since March 16.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

All of the S&P's sectors fell, led by financials, energy and materials. Oil took a sharp turn lower with West Texas Intermediate crude oil sliding 8.23 percent to $36.34 a barrel.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLF | FINANCIAL SELECT SECTOR SPDR ETF | 54.26 | +0.98 | +1.84% |

| VAW | VANGUARD WORLD FUND VANGUARD MATERIALS ETF | 234.73 | +5.28 | +2.30% |

| XLE | ENERGY SELECT SECTOR SPDR ETF | 53.25 | +1.04 | +1.99% |

The major averages finished mixed on Wednesday, with the Nasdaq closing above 10,000 for the first time, after the Federal Reserve said interest rates would remain near zero through 2022 to support the economic recovery.

President Trump, a frequent critic of the central bank who has long pushed for low-interest rates, nonetheless disputed the Fed's prediction that the comeback would be prolonged; he promised Twitter followers an upswing as soon as this fall.

In the meantime, initial jobless claims for the week through June 6 totaled 1.5 million, the government said Thursday, boosting the total number of job losses to 45 million since the shutdowns began in mid-March.

Meanwhile, Arizona and Texas were among the states that saw the number of new COVID-19 cases hit a fresh high on Wednesday while others, like California and Florida, saw infection counts near their previous peaks.

Looking at stocks, airlines, cruise operators and hotels were in the crosshairs amid fears a new wave of infections could stunt a rebound in bookings.

Drugmaker Regeneron Pharmaceuticals began human testing for an experimental COVID-19 treatment. The company will know the effectiveness of its antibody cocktail within a month.

The announcement comes after Reuters reported just before Wednesday’s closing bell that fellow drugmaker Eli Lily said one of its treatments could be authorized by September as long as trials go well.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| REGN | REGENERON PHARMACEUTICALS INC. | 785.51 | +18.88 | +2.46% |

| LLY | ELI LILLY & CO. | 1,057.80 | +38.66 | +3.79% |

Meanwhile, financial institutions remained under pressure for a second day as investors worried that an extended period of low interest rates would hurt returns.

Banks typically boost profitability by passing interest-rate increases on to borrowers more quickly than depositors, the main source of their cash. Periods of declining or unchanged rates stymie that practice.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

| C | CITIGROUP INC. | 122.66 | +6.98 | +6.03% |

| WFC | WELLS FARGO & CO. | 93.93 | +2.37 | +2.59% |

In the food sector, GrubHub is merging with Amsterdam-based Just Eat Takeaway.com in an all-stock deal that values the Chicago-based online food-delivery platform at $75.15 a share, or $7.3 billion. The deal comes after merger talks between GrubHub and ridesharing app Uber collapsed last month amid regulatory concerns.

In retail, Target hiked its quarterly dividend by 3 percent, or 2 cents, to 68 cents per share.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GRUB | NO DATA AVAILABLE | - | - | - |

| UBER | UBER TECHNOLOGIES INC. | 74.77 | -0.44 | -0.59% |

| TGT | TARGET CORP. | 115.56 | +4.66 | +4.20% |

As for metals, gold shot up 1.09 percent to $1,732 an ounce and U.S. Treasurys saw modest gains, pushing the yield on the 10-year note to 0.651 percent.

In Europe, France’s CAC paced declines, down 4.71 percent, while Germany’s DAX and Britain’s FTSE dropped 4.47 percent and 3.99 percent, respectively.

CLICK HERE TO READ MORE ON FOX BUSINESS

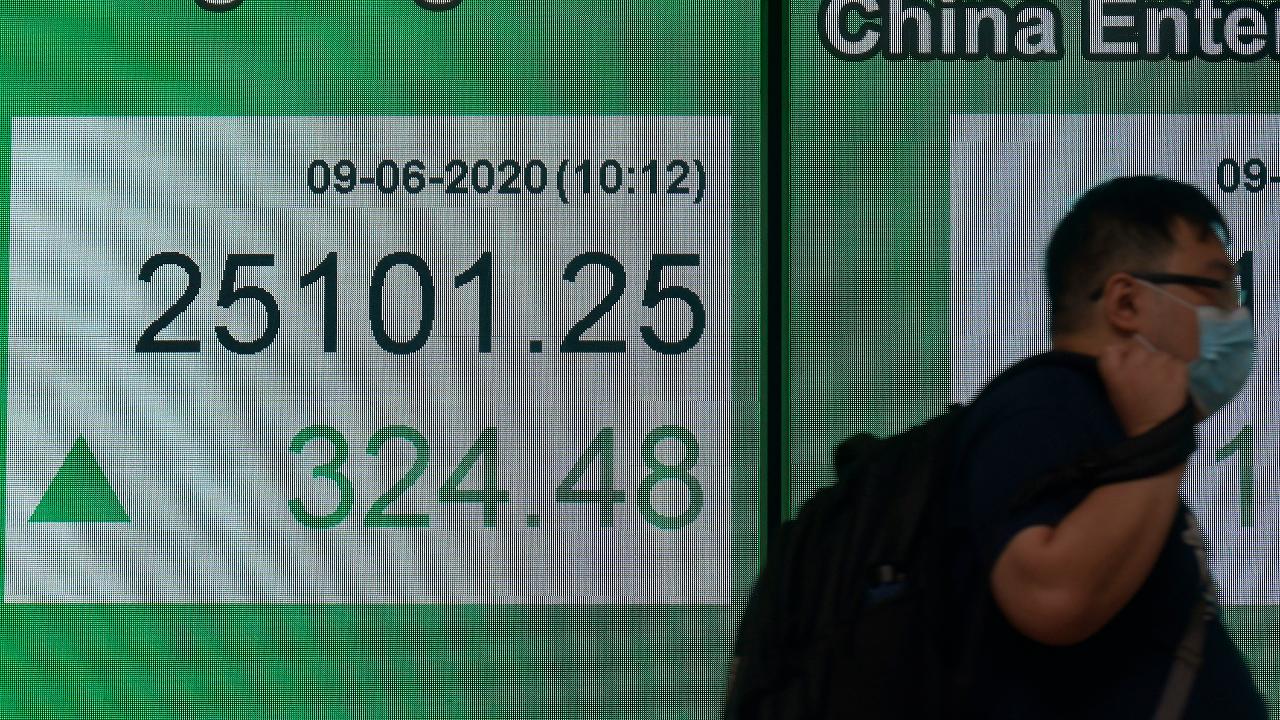

Markets were lower across Asia, with Japan’s Nikkei sliding 2.82 percent, Hong Kong’s Hang Seng off 2.27 percent and China’s Shanghai Composite down 0.78 percent.