Bloomberg's media empire could IPO or go to big tech buyers if he wins 2020 election

If Bloomberg L.P. goes on the block there are plenty of suitors

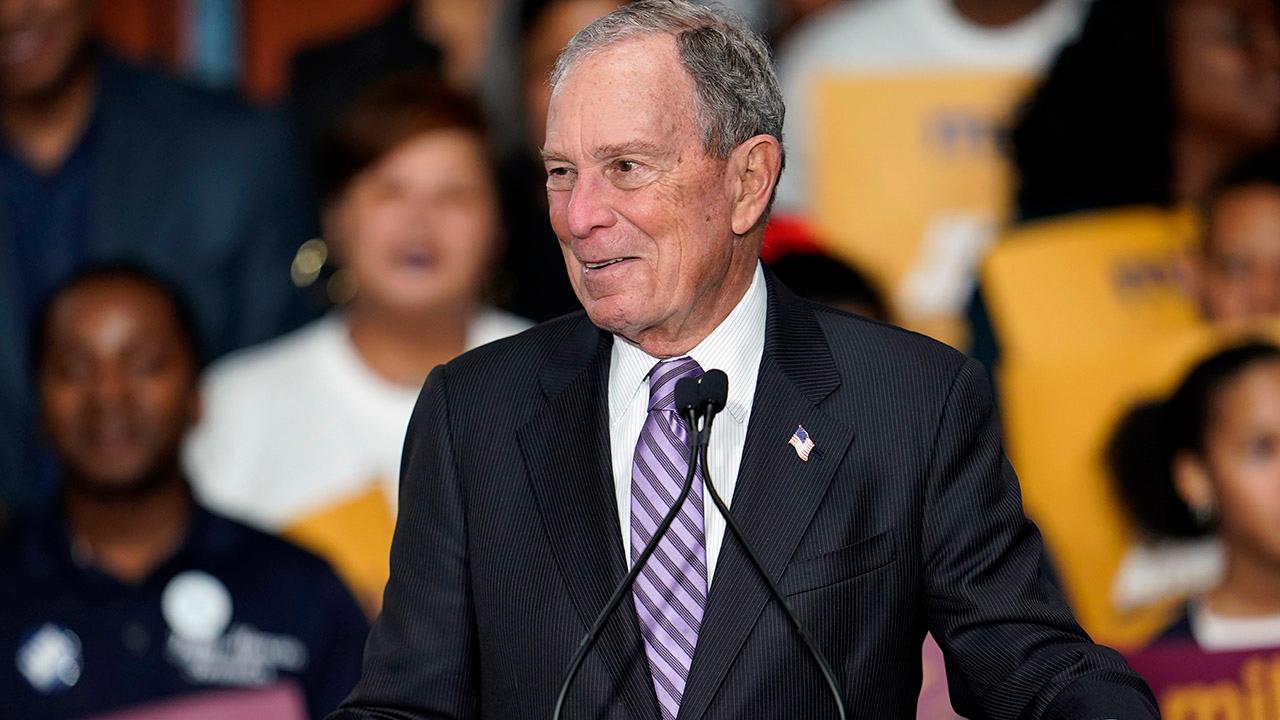

Billionaire businessman and 2020 presidential hopeful Michael Bloomberg is ready to let go of his business properties in pursuit of the White House – but what could a potential sale of the multibillion-dollar business look like?

As reported by FOX Business on Tuesday, Bloomberg is prepared to divest his media company if he wins the presidency in November. A source familiar with the matter told FOX Business that the process of selling the company would involve placing it in a blind trust before a sale.

BLOOMBERG PREPARED TO SELL MEDIA EMPIRE FOR BILLIONS ON 2020 WIN

By selling his media empire, Bloomberg is hoping to avoid conflicts of interest – questions that President Trump also dealt with. As reported by The Associated Press, Bloomberg’s restrictions on a would-be sale include that his company does not fall into the hands of a foreign buyer or a private equity firm.

That would likely cancel out heavy hitters such as Blackstone, Carlyle Group and Apollo.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BX | BLACKSTONE INC. | 125.75 | -7.13 | -5.37% |

| CG | CARLYLE GROUP | 52.98 | -1.92 | -3.50% |

| APO | APOLLO GLOBAL MANAGEMENT INC. | 118.35 | -6.50 | -5.21% |

TRUMP WOULD RATHER RUN AGAINST BLOOMBERG THAN SANDERS IN 2020

Those stipulations – particularly the no private equity preference – indicate one potential avenue for getting Bloomberg LP off of his books: an initial public offering.

“I would put an IPO out there as a possibility,” Robert Iati, director and head of the market data business at Burton-Taylor International Consulting, a division of TP ICAP, told FOX Business. “If you read between the lines on private equity, [Bloomberg] has a commitment to the employees and he does not want [the company] to be cut to shreds.”

Iati noted the strategy makes sense given Bloomberg’s overall reputation of being good to his employees.

The Bloomberg media company has an estimated valuation of $50 billion and generates an estimated $10 billion in annual revenue, according to Forbes. As its founder, he owns 88 percent of the company and has a personal net worth estimated around $64 billion.

Factoring in back taxes, capital expenditures and earnings – Reuters estimates Bloomberg LP could ultimately be worth more than $60 billion.

Given the exclusion of foreign companies, the number of U.S. companies that could purchase Bloomberg LP in its entirety is limited.

Iati said the first option might be selling to an exchange, similar to the way data analytics company Refinitiv – which has been a close Bloomberg competitor – was acquired by the London Stock Exchange.

Exchanges are looking to diversify, Intercontinental Exchange, the owner of the NYSE, was eyeing eBay for potential purchase but ceased those discussions, the company said earlier this month.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ICE | INTERCONTINENTAL EXCHANGE INC. | 154.10 | -1.07 | -0.69% |

| AMZN | AMAZON.COM INC. | 204.86 | +0.07 | +0.03% |

| GOOGL | ALPHABET INC. | 302.85 | -0.48 | -0.16% |

Another option is big data and big technology companies. That includes the likes of Amazon and Google.

Iati noted that Amazon has a tremendous presence in capital markets, but that presence – via Amazon Web Services – is “under the covers.” Google, on the other hand, does not have a big presence in capital markets – but might find the opportunity to buy into a long-term presence on desktops in “every capital market institution” very valuable, Iati said.

Other traditional technology companies – like Oracle and IBM – could also step up to the plate, as could media companies.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ORCL | ORACLE CORP. | 156.55 | +0.40 | +0.26% |

| IBM | INTERNATIONAL BUSINESS MACHINES CORP. | 256.40 | -4.39 | -1.68% |

But, the buyer might not be one company at all. In fact, it could wind up being several companies if Bloomberg LP is broken up.

“Given the diversity of Bloomberg’s business … it could be a number of companies,” Iati said, pointing to the company’s terminals, its data infrastructure system, its media assets, etc. “All parts separately, or everything together, it’s all marketable.”

CLICK HERE TO GET THE FOX BUSINESS APP

Bloomberg will participate in his first debate of the 2020 election cycle in Nevada on Wednesday, despite the fact that he is not on the ballot for the caucus. He has recently engaged in a feud on Twitter with Trump – which has covered a number of different topics. Bloomberg’s campaign is entirely self-funded.