Michael Bloomberg held talks to take his media empire public

The media giant's founder is worth $55 billion

Michael Bloomberg has been in talks to take his media empire public through an entity controlled by billionaire Bill Ackman, The Post has learned.

The former mayor of New York City and failed presidential hopeful recently entertained an offer to sell a minority stake in Bloomberg LP — the news agency behind Bloomberg Businessweek magazine and Bloomberg TV — to Ackman’s $5 billion blank-check company, multiple sources said.

WALL STREET BACKTRACKS ON 'GRIDLOCK IS GOOD' STANCE WITH POST-ELECTION STIMULUS AT RISK

If the men reach a deal, Bloomberg’s stock would trade on the New York Stock Exchange in place of Ackman’s Pershing Square Tontine Holdings, a blank-check company that’s raised $5 billion to buy or merge with another company that would then take its stock listing.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ICE | INTERCONTINENTAL EXCHANGE INC. | 154.10 | -1.07 | -0.69% |

It’s unclear whether Bloomberg will move forward with a partial sale, but the billionaire — worth an estimated $55 billion, according to Forbes —has spoken about the plan directly with Ackman, sources said.

Sources say the deal on the table calls for the three-term ex-NYC mayor — who rose to national prominence this year when he sought the Democrat nomination for president — to sell a small personal stake so he can cash out without giving up control of news agency he founded in 1981, of which he owns 88 percent.

A Bloomberg LP spokesman told The Post that the company is not for sale in any form and denied that a deal is being explored.

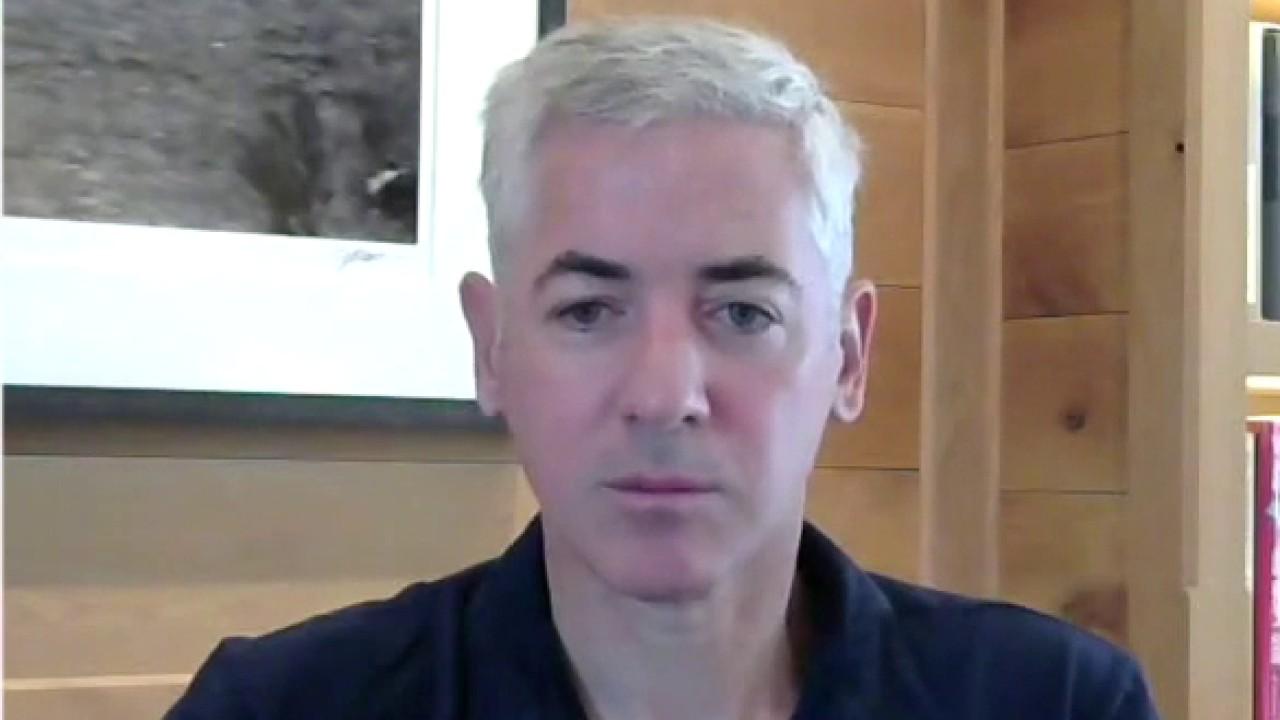

BILL ACKMAN RESPONDS TO CRITICS OF 'HELL IS COMING' TV INTERVIEW AND $2.6B WINDFALL

Ackman, who declined to comment through a spokesman, discussed the possibility of taking a minority stake in a larger company earlier this month as a way to invest the billions he’s raised in his special purpose acquisition vehicle, or SPAC.

In an interview with fellow hedge fund manager Whitney Tilson, Ackman reiterated his plans to target an entity valued between $10 billion and $15 billion, and said using that money to buy a minority stake in a far larger company could win his investors a better price.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“If you’re selling 100 percent of your company, you want the last dollar. If you’re selling 20 percent of your company in a merger which enables you to take your company public but you keep control, you’re much less price sensitive,” Ackman said in the interview.

Bloomberg LP is a $60 billion company that generates revenue of $10 billion a year. Ackman could potentially buy a 20 percent stake for $12 billion.

“Twenty percent would be the most Mike would likely give up,” added one the investment banker with knowledge of the talks. “That’s enough to float without giving up too much.”

Ackman supported Bloomberg’s ill-fated presidential run and the two men developed a personal relationship as a result, sources said. They are also both signatories of The Giving Pledge campaign founded by Warren Buffett and Bill and Melinda Gates that encourages billionaires to contribute the majority of their wealth to charitable causes before they die.

A deal with Ackman could even give Bloomberg, 78, more money to meet his giving pledge, sources said.

JCPENNEY CEO SAYS COMPANY COULD EXIT CHAPTER 11 BANKRUPTCY PROCESS BEFORE THE HOLIDAY SEASON

Ackman is a hedge fund manager known for taking big bets in companies that he’s looking to shake up, including JCPenny, Wendy’s and Herbalife, which lost him money. Over the past few months, however, he’s shifted his focus to raising billions for his special-acquisition vehicle, which is now the largest ever, and to hunting for a company to buy with that money.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WEN | THE WENDY'S CO. | 8.32 | +0.14 | +1.71% |

| HLF | HERBALIFE LTD. | 19.57 | +3.03 | +18.32% |

Sources say Bloomberg LP has long been at the top of Ackman’s list of potential acquisitions and Wall Street chatter over a potential deal picked up steam after Ackman approach to merge with Airbnb was reportedly rebuffed in August.

“He’s has wanted Bloomberg from the start,” said one Wall Streeter with knowledge of the talks. “He took a run at Airbnb, but Bloomberg was always at the top of his list and the deal makes sense. He loves Mike and it’s a huge win for him.”

MIKE BLOOMBERG, THE BILLIONAIRE

Of course, Bloomberg has long resisted overtures to take his company public or dilute his 88-percent ownership stake. But the deal Ackman has pitched would allow him to cash out some stock without having to surrender control of the company he built from the ground after it’s listed.

CLICK HERE TO READ MORE ON FOX BUSINESS

“Mike Bloomberg doesn’t need a roadshow or an underwriter, he’s too rich and everyone knows what his company does,” one investment banker told The Post. “A SPAC is a reasonable way to take his company public, or at least a minority of it.”

For Ackman, a merger with Bloomberg would be a huge win for his investors — giving them stakes in a major media company for $24 a share, which is what they paid for stock in the shell entity. It would also help cement Ackman’s transition from hedge fund manager to tycoon investor.

“If he gets Bloomberg, that’s his masterpiece” a rival hedge fund manager mused. “Even getting 15 percent of that company makes his SPAC the biggest success yet, and he can raise another $5 billion one the next day.”

Additional reporting by Josh Kosman