Disney earnings, Fed’s Powell speech, SBF bail backers? Top week ahead

Powerball soars to $747 million — fifth largest jackpot in history

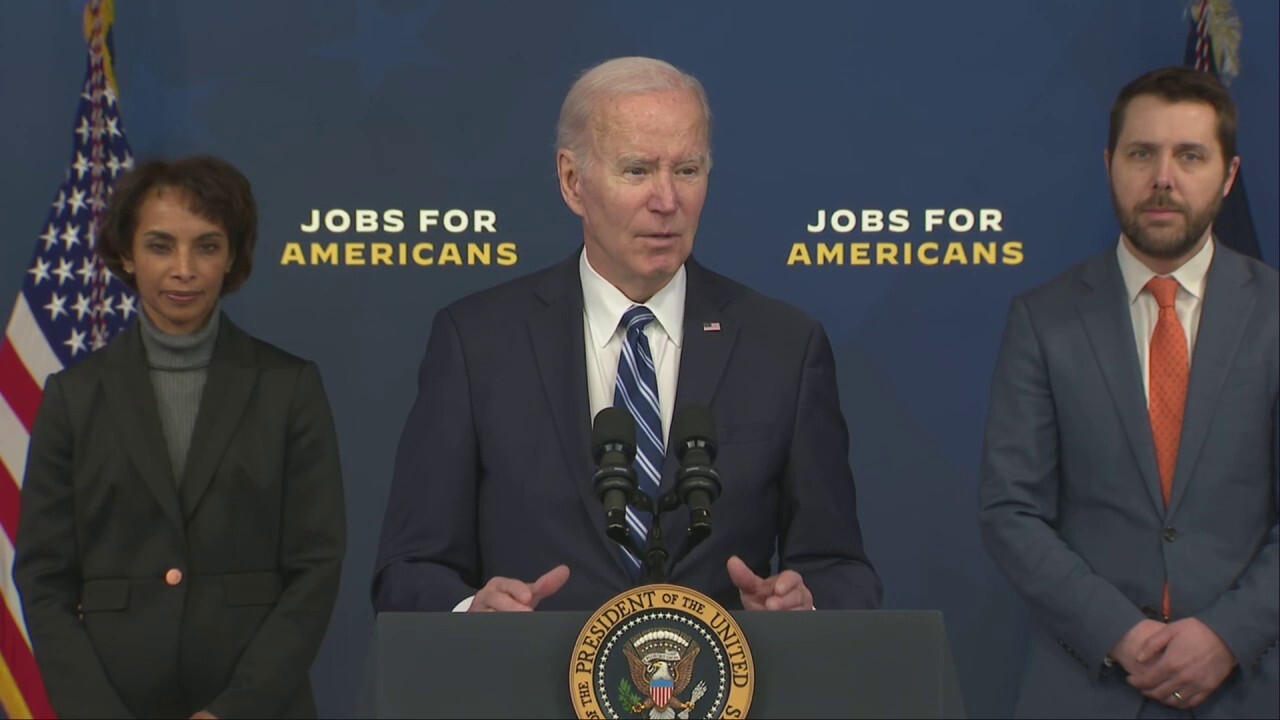

Biden claims inflation 'was already there when I got here,' says he takes no blame

President Biden touted a surge in U.S. job growth and said Friday that he takes no blame for inflation, claiming it "was already there when I got here."

Another busy week for investors is almost upon us with some major names reporting earnings, the State of the Union address and a speech from Federal Reserve Chairman Jerome Powell leading the docket.

The stock market is also coming off a solid week with the Nasdaq Composite gaining 3.4% while the S&P edged up by 1.6%. The Dow Jones Industrial Average was little changed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 22682.729157 | -70.91 | -0.31% |

| SP500 | S&P 500 | 6861.89 | -19.42 | -0.28% |

| I:DJI | DOW JONES AVERAGES | 49395.16 | -267.50 | -0.54% |

The tech-heavy Nasdaq Composite is close to exiting the bear market it entered in March 2022.

Nasdaq Composite

FOX Business breaks down this week's top market events:

BIDEN CLAIMS INFLATION 'WAS ALREADY THERE WHEN I GOT HERE,' SAYS HE TAKES NO BLAME

Monday, Feb. 6

Missouri on Monday will become the latest state to sell recreational pot to its residents aged 21 or older.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CURLF | CURALEAF HOLDINGS | 2.61 | +0.21 | +8.75% |

| GTBIF | GREEN THUMB INDUSTRIES | 6.88 | +0.39 | +5.96% |

| TCNNF | TRULIEVE CANNABIS CORP | 6.67 | +0.57 | +9.42% |

Monday will also see the arrival of a new CEO, John Koryl, at The RealReal, an online retailer for used designer and luxury fashion. Koryl will tap his experience at Neiman Marcus and eBay to drive growth at the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| REAL | THE REALREAL INC. | 11.16 | -0.26 | -2.28% |

| MCS | MARCUS CORP. | 16.49 | +0.09 | +0.57% |

| EBAY | EBAY INC. | 84.75 | +2.57 | +3.13% |

On the earnings docket are diesel engine maker Cummins as well as Energizer Holdings, ON Semiconductor, Spirit Airlines and Tyson Foods, which has recently been plagued by an avian flu that caused chicken deaths and egg prices to soar.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CMI | CUMMINS INC. | 596.58 | +3.97 | +0.67% |

| ENR | ENERGIZER HOLDINGS INC. | 22.36 | -0.47 | -2.06% |

| ON | ON SEMICONDUCTOR CORP. | 68.08 | -2.58 | -3.65% |

| SAVE | NO DATA AVAILABLE | - | - | - |

| TSN | TYSON FOODS INC. | 64.31 | +0.36 | +0.57% |

After the bell, investors will hear from Activision Blizzard, which settled with the SEC this past Friday, as well as Pinterest and Take-Two Interactive, the owner of Rockstar games and 2K.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ATVI | NO DATA AVAILABLE | - | - | - |

| PINS | PINTEREST INC. | 16.77 | +0.39 | +2.38% |

| TTWO | TAKE-TWO INTERACTIVE SOFTWARE INC. | 201.37 | +2.24 | +1.12% |

Tuesday, Feb. 7

President Joe Biden will give the State of the Union address on Tuesday at 9 p.m. EST. The speech will likely focus on the administration's past achievements and often includes plans for the upcoming year.

President Joe Biden is shown during his State of the Union address at the U.S. Capitol on March 1, 2022. (Jim LoScalzo / EPA / Bloomberg via Getty Images / Getty Images)

Tuesday may also see Sam Bankman-Fried's (SBF) bail backers revealed unless a court appeal is accepted. SBF's bail was secured at a record $250 million dollars, leaving many asking where the money came from.

SAM BANKMAN-FRIED BARRED FROM CONTACTING FTX EMPLOYEES, USING SIGNAL MESSAGING APP

Sam Bankman-Fried leaves court in New York on Jan. 3, 2023. (Fatih Aktas / Anadolu Agency via Getty Images / Getty Images)

Congress on Tuesday will host a hearing on "FAA Reauthorization: Enhancing America’s Gold Standard in Aviation Safety," which comes after some major hiccups at Boeing and some recent general aviation incidents.

Also, Powell will give a speech on Tuesday this comes after the central bank last week raised interest rates by a quarter of a point and signaled that it will continue to raise interest rates for the time being.

Federal Reserve Chairman Jerome Powell (AP Photo / Susan Walsh / Pool / File / AP Newsroom)

Earnings on Tuesday also include DuPont, Hertz Global, KKR, Royal Caribbean and Western Union.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DD | DUPONT DE NEMOURS INC. | 50.23 | -1.11 | -2.17% |

| HTZ | HERTZ GLOBAL | 4.68 | -0.62 | -11.70% |

| KKR | KKR & CO. INC. | 101.69 | -1.91 | -1.84% |

| RCL | ROYAL CARIBBEAN GROUP | 310.38 | -8.35 | -2.62% |

| WU | THE WESTERN UNION CO. | 9.44 | -0.20 | -2.13% |

After the bell, Chipotle Mexican Grill, Container Store, H&R Block, Prudential Financial and Trivago all report.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CMG | CHIPOTLE MEXICAN GRILL INC. | 37.97 | -0.75 | -1.94% |

| TCS | NO DATA AVAILABLE | - | - | - |

| HRB | H&R BLOCK INC. | 30.83 | -0.85 | -2.68% |

| PRU | PRUDENTIAL FINANCIAL INC. | 102.69 | -1.61 | -1.54% |

| TRVG | TRIVAGO NV | 2.99 | 0.00 | 0.00% |

Investors will be paying close attention to the Balance of Trade and change in consumer credit both being announced on Tuesday. The U.S. trade deficit is expected to expand from $61 billion to $68 billion this week, and consumer credit is expected to fall from $28 billion to $24 billion.

Wednesday, Feb. 8

On Wednesday, General Motors will unveil the 2024 Chevy Trailblazer and Toyota will unveil the Grand Highlander as the two companies fight for car market supremacy.

GM RETAKES TOP SALES SPOT FROM TOYOTA WITH STRONG 2022 FINISH

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 81.47 | -2.20 | -2.63% |

| TM | TOYOTA MOTOR CORP. | 241.65 | -1.55 | -0.64% |

John Williams, president and CEO of the Federal Reserve Bank of New York, will speak on Wednesday.

CVS, WALMART CUT PHARMACY HOURS AS PHARMACIST SHORTAGE PERSISTS

In the morning, investors will devour earnings reports from CVS Health, Dominion Energy, Emerson Electric, New York Times, Penske Automotive Group, Uber, Under Armour and Yum Brands. Yum Brands is the owner of well-known brands that include KFC and Taco Bell. Fox Corp., parent of FOX Business and Fox News, will also report.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVS | CVS HEALTH CORP. | 77.31 | -0.43 | -0.56% |

| D | DOMINION ENERGY INC. | 65.48 | +0.78 | +1.21% |

| EMR | EMERSON ELECTRIC CO. | 151.30 | +0.16 | +0.11% |

| FOXA | FOX CORP. | 56.16 | -1.01 | -1.77% |

| NYT | THE NEW YORK TIMES CO. | 75.49 | -0.01 | -0.01% |

| PAG | PENSKE AUTOMOTIVE GROUP | 165.66 | -2.47 | -1.47% |

| UBER | UBER TECHNOLOGIES INC. | 72.94 | +0.17 | +0.23% |

| UAA | UNDER ARMOUR INC. | 7.71 | -0.14 | -1.85% |

| YUM | YUM! BRANDS INC. | 163.48 | +0.57 | +0.35% |

After market close, investors will tune in to earnings calls from 23andMe, Mattel, MGM Resorts, O’Reilly Automotive, Robinhood Markets, Sonos and Walt Disney.

The Mouse House will be closely watched as returning CEO Bob Iger faces off with activist investor Nelson Peltz.

Nelson Peltz, founding partner of Trian Fund Management LP (Reuters / Mike Blake / File / Reuters Photos)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DNA | GINKGO BIOWORKS HOLDINGS INC | 9.69 | +0.74 | +8.27% |

| MAT | MATTEL INC. | 17.42 | +0.14 | +0.81% |

| MGM | MGM RESORTS INTERNATIONAL | 36.46 | -0.73 | -1.96% |

| ORLY | O'REILLY AUTOMOTIVE INC. | 94.17 | +1.42 | +1.53% |

| RBNHD | NO DATA AVAILABLE | - | - | - |

| SONO | SONOS INC. | 15.66 | -0.04 | -0.25% |

| DIS | THE WALT DISNEY CO. | 106.02 | -1.10 | -1.03% |

Economic data piquing investors' interest on Wednesday will include mortgage applications, wholesale inventories, wholesale sales and EIA weekly crude stocks.

Thursday, Feb. 9

Thursday will see the beginning of the Chicago Auto Show, which runs through Feb. 20. Subaru is set to unveil the 2024 Crosstrek on opening day.

A Ford Maverick is shown at the Chicago Auto Show. (Scott Olson / Getty Images / File)

As for earnings, Hilton Worldwide, Kellogg, PepsiCo, Philip Morris, Ralph Lauren, S&P Global, Thomson Reuters and Warner Music Group all report.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HLT | HILTON WORLDWIDE HOLDINGS INC. | 312.72 | -3.07 | -0.97% |

| K | NO DATA AVAILABLE | - | - | - |

| PEP | PEPSICO INC. | 164.59 | +0.20 | +0.12% |

| PM | PHILIP MORRIS INTERNATIONAL INC. | 183.50 | +0.83 | +0.45% |

| RL | RALPH LAUREN CORP. | 376.82 | -1.25 | -0.33% |

| SPGI | S&P GLOBAL INC. | 416.51 | -2.88 | -0.69% |

| TRI | THOMSON REUTERS CORP. | 85.16 | -0.53 | -0.62% |

| WMG | WARNER MUSIC GROUP CORP. | 29.21 | -0.04 | -0.14% |

After the bell, investors will be tuned into results from Expedia, Lions Gate Entertainment, Lyft, Motorola Solutions, Nautilus, PayPal and Yelp.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LGF.A | NO DATA AVAILABLE | - | - | - |

| LYFT | LYFT INC. | 13.90 | +0.19 | +1.39% |

| MSI | MOTOROLA SOLUTIONS INC. | 453.68 | +2.08 | +0.46% |

| NLS | NO DATA AVAILABLE | - | - | - |

| PYPL | PAYPAL HOLDINGS INC. | 41.73 | +0.28 | +0.68% |

| YELP | YELP INC. | 21.48 | -0.21 | -0.97% |

Friday, Feb. 10

Economic data to round out the week will include the University of Michigan's consumer sentiment index, which is expected to remain at 64.9, and the federal budget.