Jobs, GM, Amazon earnings top week ahead

Employers are expected to have added 210,000 jobs in January

‘Don’t be swayed by these short-term market durations’: Mahn advises investors on revisiting their portfolios

Hennion & Walsh Asset Management president and CIO Kevin Mahn discusses advice for investors after choppy sessions and says to remain ‘true to risk-tolerance and long-term objectives’ on ‘The Claman Countdown.’

Investors are set for another busy week of earnings and economic data, including the January jobs report.

It may also be another volatile week for stocks after all three of the major averages closed on a high note Friday capping off a wild but winning week as investors jostled concerns over inflation and faster-than-expected rate hikes.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

JOE ROGAN, SPOTIFY CONTROVERSY RAGES AS MORE ARTISTS MULL FUTURE

FOX Business takes a look at the upcoming events that are likely to move financial markets in the coming days.

Monday 1-31

Citigroup is expected to begin firing employees who are not vaccinated setting the stage for other corporations.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| C | CITIGROUP INC. | 122.66 | +6.98 | +6.03% |

On the earnings docket reports from Cirrus Logic and NXP Semiconductors will be closely watched. While the Chicago Purchasing Manager's Index will lead a light economic calendar.

Tuesday 2-1

On Tuesday, the JOLTS report, which tracks the number of open jobs and the pace of quitting, will be released at 10 am ET for December. The prior month saw a near-record 10.6 million positions remaining open, while more workers quit, with 4.5 million or about 3% of the workforce bolting their jobs in November, matching the high from September.

AMERICANS QUIT JOBS AT RECORD PACE

Additionally, car sales, construction spending, and ISM manufacturing will be released.

It will also be a busy day for earnings with Exxon Mobil, UPS, and PulteGroup before the market opens.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| UPS | UNITED PARCEL SERVICE INC. | 117.34 | +0.79 | +0.68% |

| PHM | PULTEGROUP INC. | 135.06 | +1.04 | +0.78% |

Advanced Micro Devices, General Motors, Google, Starbucks, and PayPal will report after the close of trading.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMD | ADVANCED MICRO DEVICES INC. | 208.44 | +15.94 | +8.28% |

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

| SBUX | STARBUCKS CORP. | 99.45 | +3.38 | +3.52% |

| PYPL | PAYPAL HOLDINGS INC. | 40.42 | +0.52 | +1.30% |

In management news, Southwest Airlines will welcome new CEO Bob Jordan who takes over from a retiring Gary Kelly.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LUV | SOUTHWEST AIRLINES CO. | 54.25 | +1.75 | +3.33% |

In an email to customers distributed Friday Jordan wrote:

"For me, this is a season of gratitude and anticipation. After more than 30 years at Southwest, I have the privilege of stepping into the role of CEO on February 1. When I started as a Southwest programmer in 1988, I never dreamed this could be possible, but at Southwest Airlines, all things are possible. It's an honor to serve you and our People; I'm humbled by the opportunity, ready for the job and excited about what's ahead for our great Company."

(Christopher Goodney/Bloomberg via Getty Images / Getty Images)

Wynn Resorts will also welcome Craig Billings, who ran the casino's interactive arm, to the CEO role.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WYNN | WYNN RESORTS LTD. | 117.96 | +4.76 | +4.20% |

Wednesday 2-3

Wednesday, investors will get the first taste of the 2022 job market with the release of ADP's private employment report due at 8:15 am ET. The data is viewed as a precursor to the monthly government numbers due Friday. Weekly mortgage applications will also be released.

In earnings, before the bell homebuilder, D.R. Horton will report and the pace picks up after the bell with Facebook, now known as Meta Platforms, MetLife, T. Mobile, Qualcomm and Spotify will report.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DHI | D.R. HORTON INC. | 156.27 | -1.86 | -1.18% |

| FB | PROSHARES TRUST S&P 500 DYNAMIC BUFFER ETF | 42.42 | +0.35 | +0.84% |

| MET | METLIFE INC. | 76.39 | +1.04 | +1.38% |

| SPOT | SPOTIFY TECHNOLOGY SA | 422.50 | +9.84 | +2.38% |

| TMUS | T-MOBILE US INC. | 197.39 | -4.47 | -2.21% |

| QCOM | QUALCOMM INC. | 137.34 | +1.04 | +0.76% |

Spotify is dealing with an artist revolt after Neil Young and Joni Mitchell pulled their respective music catalogs from the platform in an act of protest against Joe Rogan for spreading misinformation about the pandemic on his podcast, they alleged. Spotify backed Rogan.

Additionally, OPEC and non-OPEC ministers will meet in Vienna. Oil topped $88 per barrel in the prior week.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

Chevron CEO Mike Wirth, telling FOX Business last week, oil could move to $100 per barrel.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Thursday 2-4

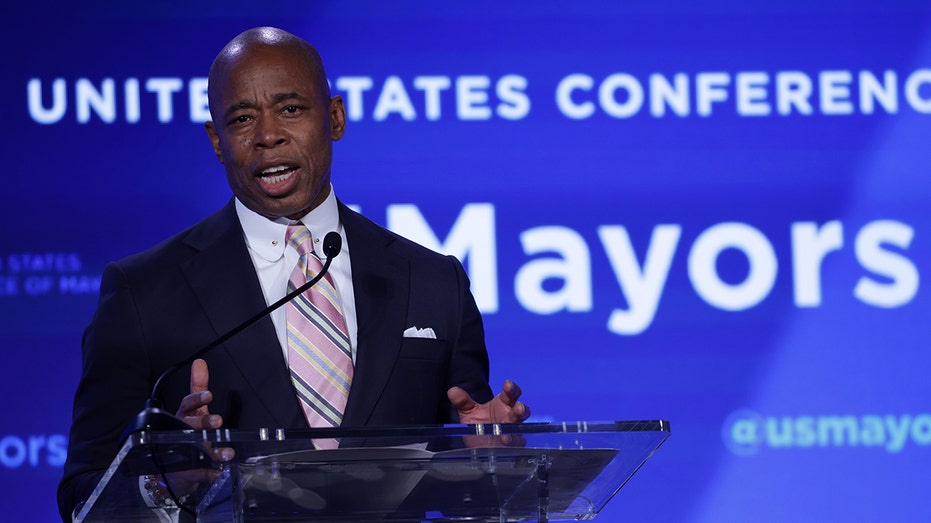

Thursday, President Biden is set to visit New York City and meet with Mayor Adams as gun violence escalates. Last week, NYPD Police Det. Jason Rivera, 22, was laid to rest after being ambushed during a domestic disturbance call. His partner, Officer Wilbert Mora, 27, was also killed.

(Photo by Alex Wong/Getty Images / Getty Images)

This comes as the city's business leaders and CEOs ramp up the pressure on D.A. Braggs who has laid out a soft on crime agenda early into his term. Deloitte Consulting employee Michelle Go was pushed to her death on the subway tracks in Times Square last month.

In earnings, Eli Lilly and Hershey will report before the market open, while Amazon, Ford, News Corp and Activision Blizzard report after.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LLY | ELI LILLY & CO. | 1,057.80 | +38.66 | +3.79% |

| MRK | MERCK & CO. INC. | 121.93 | +2.18 | +1.82% |

| HSY | THE HERSHEY CO. | 231.57 | +7.29 | +3.25% |

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

| F | FORD MOTOR CO. | 13.80 | +0.08 | +0.58% |

| NWS | NEWS CORP. | 25.65 | -1.74 | -6.35% |

The video-game maker recently announced plans to be acquired by Microsoft for $69 billion in what is the software maker's largest acquisition.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

| ATVI | NO DATA AVAILABLE | - | - | - |

Additionally, Sotheby’s will open an auction of its 555.55 carat black diamond called The Enigma. Crypto payment will be accepted through February 9.

(AP Photo/Kamran Jebreili / AP Newsroom)

Friday 2-5

On Friday, the all-important monthly jobs report for January will give the first glimpse of the 2022 labor market.

Employers are expected to have added 210,000 workers, up from December's 199,000. The unemployment rate is expected to hold at 3.9%, according to economist estimates.